Make better money decisions with MoneyLion. Access mobile banking, personal finance resources & fast cash for extra money when you need it. Discover tools, insights, & offers for every money moment in your life.

GET PAID EARLY (UP TO 2 DAYS)² - ROARMONEY BANKING

Fast forward to payday with RoarMoney℠ direct deposit. Open a RoarMoney banking account and invest your extra cash with Round Ups³. *Earn up to a $55 bonus⁴ when you join and create a RoarMoney account and link qualifying direct deposits! (Use code: ROARBONUS)

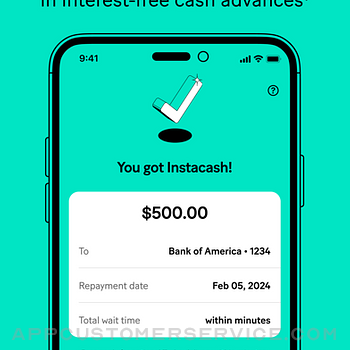

QUICK CASH ADVANCE UP TO $500¹

Access up to $500 of your pay, any day with Instacash℠ cash advances. Get money in minutes with no interest, no mandatory fees, & no credit check. Increased limit up to $1,000¹ with qualifying recurring direct deposits.

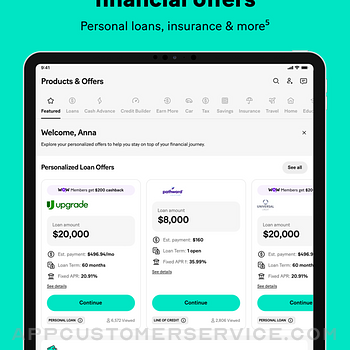

FAST LOAN OFFERS⁵

Need to borrow money? Get matched with personal loan offers from partners on the MoneyLion Marketplace. Compare offers for personal loans, small loans, online loans, savings accounts, & more.

CREDIT BUILDER LOAN⁶

Access a Credit Builder loan of up to $1000 & exclusive services with a membership.

MoneyLion is not affiliated with other money apps, loan apps, or instant cash advance apps such as Dave, Beem, Self, Varo Bank, Possible Finance, TurboTax, IRS2Go, TaxAct, Earnin, Empower, Cleo, Brigit, or Kikoff

1 Instacash is a 0% APR cash advance service provided by MoneyLion. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. This service has no mandatory fees. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. For a $40 Instacash advance with a Turbo Fee of $4.99, your repayment amount will be $44.99. Generally, your scheduled repayment date will be your next direct deposit date which can range from weekly to monthly depending on your deposit cycle. An Instacash advance is a non-recourse product, not a personal loan, and there is no mandatory minimum or maximum timeframe for repayment; you will not be eligible to request a new advance until your outstanding balance is paid. See Membership Agreement and http://help.moneylion.com for additional terms, conditions and eligibility requirements.

Increased Instacash limit with Safety Net requires recurring direct deposit into RoarMoney account. Instacash is an optional service offered by MoneyLion. Terms and eligibility requirements apply. See Instacash Terms and Conditions for more information.

2 With direct deposit. Faster access to funds is based on comparison of a paper check versus electronic Direct Deposit.

3 Round Ups is subject to terms and conditions. This optional service is offered by MoneyLion. You may be required to have certain MoneyLion accounts to use this feature.

4 Referral Promotion is subject to Terms and Conditions.

5 Personal loans in the MoneyLion marketplace you may apply for have repayment terms from 12 months to 84 months. For example, if you receive a $10,000 loan with a 60-month term and a 16.21% APR, your required monthly payment would be $244.30 ($135.09 Principal + $109.21 Interest). Assuming all 60 payments are made on-time, the total amount paid would be $14,657.87. All loan offers on the MoneyLion marketplace require your application and approval by the lender. Depending on the lender, other fees may apply, such as origination fees or late payment fees. See lender's terms and conditions for additional details. You may not qualify for the lowest rates or the highest offer amounts or may not qualify for a loan at all.

6 Credit Builder loans are made by either exempt or state-licensed subsidiaries of MoneyLion Inc. NMLS 1237506

MoneyLion: Cash Advance App Positive Reviews

Waste of timeI received numerous emails and text on how I was approved for the $500. I entered in banking info and had to manually send in bank statement since it had to be verified. I was then told by representative , an email and text my bank passed the screening process and to continue with the next steps online, after re-verifying my banking info as asked it stated my account/rousting number didn’t match. I called back after waiting on hold for 25 minutes and was told they support team updated it in the system and to retry. I did it again and now received error message my bank isn’t supported! I called back and was told my bank was verified and passed the process on their end but wasn’t sure why I was receiving error online. In the meantime I’m still receiving text and emails telling me I can proceed to get the money....long story short no one can assist with why or how the online system is blocking my banking info saying it’s not supported I was even told to try and use the MoneyLion checking account to have funds deposited by a representative and transferred to that department and after being on hold 30 minutes this time I was told the MoneyLion checking account hadn’t been open long enough! Complete run around for the past 2 weeks and to this day I’m still receiving offers to apply and that my bank passed the screening process. Frustrating to do all of this for no resolution !!!!!.Alesha0629Version: 5.6.0

Great appI love this app, I love that the round ups are invested at a 1.00 most apps make it minimum 5.00 the point is to invest your change if you buy a coffee for a 1.50 you want the .50 cents invested not hold it until

5 bucks that is a noticeable withdrawal. Soon you can split the round up between investment and crypto. The atm fees can be high with both the atm and app charging you. Great Cashback and reward choices it adds up quickly. Direct deposit comes earlier than my regular bank. My only complaint is that I have both my paychecks directly deposited to the site and I love that instacash boost and credit builder coming out automatically, but I've tried to use payday advance app and even have applied for a loan and both would not accept moneylion as a bank so I did it get approved solely for that reason. So basically if I need to take a true loan I'll have to have my checks directly deposited elsewhere and it'll take weeks for that to happen and for the companies to see that the checks have been coming frequently to that account. I hope sooner than later places recognize them as a financial institution and not just a finance app because it's basically like showing no income. Those few negatives do not hinder the app at all the credit bulder, instacash, and investments are worth it on their own..Mleopard77Version: 7.45.0

SCAMI NEVER write reviews but I felt the need to write one today. First, I completely understand that a lot of people are struggling out there and desperate times cause for desperate measures but please don’t download this app. About a couple weeks prior to Christmas I decided to use this app to take an advance on my check and also signed up for the Roar checking account and direct deposit which was a even bigger mistake. Long story short, if you open a Roar account, you are giving them access to just go into your account without your permission and take your money. I had a separate account for advances which is also the account that should be used to pay back advances but when I set up direct deposit with the Roar Checking account, as soon as my check for my part job hit the Roar account they went in and took my entire check without my permission or prior notification. What made this very upsetting was that was my last check before Christmas so I literally had no money for Christmas. I called them and they told me there was nothing they can do. I worked in a call center before and the number one indicator that a company is crap is if you escalate to speak with a supervisor but you’re on hold for over an hour because all supervisors are on another escalated call. HUGE red flag..K AdlamVersion: 7.66.0

Best pay card ever!!I’ve had a ton of regular bank accounts you know Wells Fargo Bank of America, South Sound bank, go bank, and none of them were as good as MoneyLion, not a one of em’!! I think their features are awesome they’re helpful and they come in handy when you need it. I referred my wife to use her P card to work to have her check direct deposited because of the Insta cash which is amazing to be able to get it in also I was able to get a boost in my Insta cash or referring her so everybody want! I really would recommend this card to anyone that is looking for a non-traditional think who treats their clients correctly by rewarding them for using their service instead of charging them for you after feel like they have to pay for the bank to operate when half the people in the bank or just standing around asking you if you’re waiting in line I am so tired of going into banks in being “helped”, and leaving like I talk to a brick wall or a child or a person with a IQ of six MoneyLion has never been a bad experience they’ve always been able to help me work things through if there any issues they say they help you and the amount of perks on their accounts are amazing I mean it’s just almost limitless they come up with new stuff all the time so go MoneyLion keep it up hurrah.Tavis6060Version: 7.35.0

Great investmentSo I’ve been a member for a full 30 days now. I was very skeptical at first, I wanted to cancel after my first payment because I read some negative reviews. But, thinking about the situation a little longer I realized all the negative reviews have one thing in common, and that’s because these people didn’t read the documents or what they were signing up for. So I left it at that! Now if you don’t have the money monthly to pay both the membership fees and the loan. Then I wouldn’t suggest this app, cause you need to spend money to make money, if you have no money then you can’t make any. Anyways, you pay a membership fee of $33 and some change every two weeks. $50 of that goes into your investment account. That is STILL your money! It’s just in a savings account for you basically. ML couldn’t verify my bank account so I was in something called the LOANLocked group. I had to make sure to pay my membership ON TIME, auto-drafted from my bank account. 30 days later with no questions asked I was approved without running my credit for the $500 loan. I don’t have this app just for the loan. I have it to build my credit, and the ongoing investment. I would recommend this app to my close family and friends because I trust it. AGAIN READ what you’re signing up for. ☺️☺️☺️☺️.Rosslynn N.Version: 4.5.0

MUST READ - SCAMI had to put 5 stars otherwise this review would have been sent all the way to the bottom where no one looks. MONEYLION SELLS YOUR INFORMATION TO INDIA CALL CENTERS TO SCAM YOU WITH FAKE LOANS!!! I applied on their app and it sent me to a website called “loanup”, and I applied there again, and nothing was approved and the page was not visible. 4 mins later I get several calls and text messages from Indian people who are offering me loans with low interest and low monthly fees. Come to find out these are scamming Indian call centers that have been stealing from Americans for the last 8 years. I have proof also. I tried to talk to MoneyLion’s chat help and asked for a supervisor but they wouldn’t give me their email so I can complain, so this was the only way. Moneylions SELLS your information to Indian call centers just so they can scam you. The police said they can’t do anything about it, but they are going to put MoneyLion on a national database so they can research this. I have been using MoneyLion for instacash and the credit builder plus loans, and I’m appalled that they have sold my information to India. My social security, name, address, date of Birth….all sold to those scamming people. This is so bad. Please beware people..SharpyusaVersion: 7.55.0

Great money maker/investment/credit builderI took a chance with ml for the loan opportunity and I'm so glad I did. From the low interest rate on the loan I received, to the opportunity for financial growth by earning a dollar a day to build on my investment just for opening up the app and swiping, all the way to helping me build my credit I have to say the decision I made to take a chance was actually one of the best decisions I've made in regards to finances. I do however need to let it be known I am not so happy with my ml checking account, I opened the account because it said free checking account and over 55,000 free atm's but yet the first time I used my card to withdraw money out of an atm I was charged twice one charge was the typical $2 atm fee from the atm's financial institution but then I saw when I was looking at my ml checking account transactions that I was also charged $2.50 from ml as well on top of the $2 atm fee I had already paid. I should not have had to pay a fee to ml as well as pay one to the financial institution of the atm I withdrew from! Now I worry every time I need to make a purchase hesitating and debating on whether or not to use my ml card wondering if I'll be charged for doing so. That is something I should never have to worry about from my personal bank account/institution especially if you were told prior to opening it it's a free account..Dgirl0220Version: 5.8.0

Four Stars Cause Some Hidden FeaturesMoneyLion is a pretty neat app, and banking platform. While I do enjoy many things about it, I had to give four stars because there are some features I dislike. One, membership fees, I mean on top of other fees and being bombarded to provide tips with the InstaCash feature is excessive. But the one that irked me the most was the additional charge of 20% to my transactions to “account for” gratuity… That should be my own decision and in terms of what I chose to give. While the amount does shift once a transaction has completed processing, it creates a GREAT inconvenience when trying to budget because on TOP of the gratuity I am already factoring for, I got some other underhanded weird banking feature doing it’s own thing. Not appreciated. And I know this can cause problems for other people especially in tight money situations. So, you have been forewarned should you read this before downloading. We already got drama going on with Bank of America being shady, don’t need that elsewhere. Aside from that annoying part, overall other factors have me sticking with the app for now. At least compared to other mobile banking apps, this one is the best. Just watch out for things like aforementioned which can sour your mood on any given day..SabzBabzVersion: 7.79.0

Life RaftI’ve read where some people say that they had a hard time getting set up with Money Lion but in my experience it was straight forward, and there weren’t a lot of hoops to jump through. I got my mom set up with them in just a couple of minutes and she hasn’t had any problems with them either. It wasn’t a whole lot that they had approved me for, but I was able to use their task & reward system to increase the amount. Like most of the lending apps if you directly deposit your paycheck with them they increase your limit even more. And you know what? With the smooth history that I e had with them and their other app features, I’m going to do the direct deposit with them. My bank doesn't give me cash advances when I need them. Also I like their tip system. They don’t charge interest on the loan they ask for a tip. They do cap you at $50 a transaction so you’ll have to tip again, but nobody’s making you tip. I leave what I think is fair for what I’m trying to take out. I know this must sound like a paid review but I chose to leave this review, they didn’t make me in order to continue to the app like some apps. Anyway, that’s my take..Lil Fooz Ball BoiVersion: 7.34.0

Scammers and a jokeI was told I had to sign up for their membership to use anything. I then signed up and I couldn’t use a single one of their products because they “couldn’t verify my identity” because one of their phone reps changed my name to the wrong name? My first name is two words and they said their system doesn’t support first names with spaces in it so she just put the first part of my name???? I have been asking for them to update my name for almost a month now and nothing? They are now refusing to delete my account saying they can only deactivate my account but even then when they say my accounts been deactivated it’s not? The reason they tell me they can’t delete my account is because they have to retain my personal information due to “Bank Security Act”. Nothing about the bank security act says they have to retain my information and can’t delete my account. I don’t even have a bank account with them or anything, no instacash, no loan, nothing so the only reason why they want to retain my information is to sell it. This app is a joke, this company is a joke and they don’t give a crap. STAY AWAY!!!!.Skwak KwakVersion: 7.82.0

Great but the tip portion is ridiculous and needs more infoI can honestly say I love this app. Hands down really great at looking at all your money at once. There’s an option to invest, but it doesn’t explain anything about the investing. You have no idea what your invested in and what’s happening with that money. Also, you don’t have the option to take that money back if you no longer want to invest, which is a little ridiculous. The credit building is great, it reports to the credit bureau appropriately and you see the impact quickly. However, the instacash option is ridiculous. When you take out an instacash it constantly asks for a tip. I don’t mind leaving a tip for the help but if you don’t leave a tip your amount of instacash lessens, like a punishment for not paying more. Finally the last complaint would be the cashback shake that they offer. It’s a fun little option and it doesn’t give much back which isn’t an issue. The issue is that you can’t choose where that cashback goes. It immediately goes to the investment, which again you know nothing about. There should be an option of putting the cashback in the checking or in the investment. Overall a good app and great tool for improving credit and having some extra cash here and there but it needs some improvement..Grace121595Version: 6.13.0

HelpfulIt’s not easy when you live paycheck to paycheck and it’s not easy looking for different ways to make sure you aren’t counting down to the final dime to get to your next. This app does help. Not just by helping you access your check early but, by having so many other options and advice. Different avenues to help you save and learn how to money manage. It’s filled with tools if you want more than just trying to make it to each paycheck. Small loans, big loans, credit building, debt consolidation and credit score info. It’s not there as a quick fix and to put you further in debt. As someone who grew up living paycheck to paycheck I know very little about how to build credit and properly manage money because it seems like the minute I get it well it’s gone. I’m not too proud to say that I’m not money savvy. Or that my family were not and are not credit building types. It was always. Survive and you’re okay. That doesn’t help you much. This app is helpful and very user friendly. I’m not on top of my game yet. But I feel like I can be eventually. And this app does help. So yes, I highly recommend..PaulinakirstionnaVersion: 7.45.0

DON’T USE APP!!!!!!!!!!!!This is the worse app ever! I tried to give it a chance after the first major mistake. But after having to deal with it again the next month, shows me it’s not worth it! The first incident was when I checked my repayment date, I noticed it had changed. I get paid once a month so my repayment is on the next pay period, yet the app changed the date to middle of the month! When I checked why it changed it was bc my minor child’s bank acct had a deposit of money. Her acct is linked to mine for management reasons only! I do not have access to her monies. Her acct is under her social and her name. Money lion initiated a repayment from her acct without authorization! That’s stealing! That’s not the acct or debit card I signed up with and they should not be able to steal money from other peoples accts just bc they’re linked! I called for help and I had to delete all accts from app and then re-link and verify with my acct so it would only draft the repayment from MY ACCT. I was told the problem was solved. Then this month the same thing happened! 1 Star rating I’m deleting after I pay them back! Horrible experience!.BexariniVersion: 7.17.0

Buggy and disappointingThere is consistently lots of bugs in this app and I’ve had it for over a year now. I pay for a MoneyLion premium membership and the credit advice feature has never worked for me. It freezes up the app after answering the security questions. The flow of the app is not logical. Making the smallest changes like an address change is even a difficult process. All MoneyLion users were recently forced to switch from MoneyLion checking to a Roar Money account. In doing so, we had to let our MoneyLion accounts close after opening the Roar Money account. We now pay a monthly fee as well. I used to schedule money transfers from my Wells Fargo account to MoneyLion twice a month, and I tried to link my WF account to this new Roar Money account and it shows that it does not qualify for transfers with WF. I’m super disappointed. I really liked my MoneyLion account and now I’m paying for an account I can’t even make transfers to or find an ATM for. It’s a hassle. I’m trying to close the RoarMoney account I just opened and I can’t find where to do that, just like everything else in the app. There is not a phone number to call or a chat to get help. You have to fill out a stupid help form on their website for every little thing..Haley BugVersion: 7.5.0

It’s really a 5 StarI would have given MoneyLion a 5 star rating if it wasn’t for the verification system they have in place. But I can also blame them for the glitches because customer service seems to know what’s going on but doesn’t come right out to tell you, and that makes the verification go on for weeks. If some would have taken the time to explain I would have given 5 stars. After answering about 4 questions about myself which I answered CORRECTLY the computer told me I was wrong and I would get another try, the second time the same thing my answer were ALL CORRECT but there was no third try it told me I had to wait a week then reapply for the checking account which gives you a lot more options when it comes to borrowing money. Which in a sense is ur own money. But what gets me is why not just tell me I’m not eligible for the checking but I’m ok for the investment part which I really like and think it’s an Awesome way to save & invest at the same time. I wish I could get the checking account that would complete my portfolio! I still recommend investing it’s worth it, now and for the future!!! BeeMan.BeeBoiVersion: 5.8.0

Changed my lifeHonestly. Too much to say. But not enough time with the hustle known as life. MoneyLion has saved me numerous times. From issues with overall finances. Bailing me out of tight situations where a little extra was just needed when emergencies happen. Sometimes no matter how hard you budget. When stuck in the repetitive middle class where taxation on wages earned is more impactful than those above and below. Where trying to break the cycle of living paycheck to paycheck is seemingly not plausible. It really helps to be able to get by. As any business model will prove. Products and services do come with a cost. Regardless of the 7.99 instant transfer fee. Or the constant bombardment of tip inquiries. Nothing is free. However. It is all reasonable. I can without a doubt say that in terms of consistency, Accessibility, and options presented by this company. That it has well been worth it to me. But I’m just some random dude. There are no subscriptions or monthly fees for the program. They offer an array of services. So if your curious. Find out for yourself. Thank you MoneyLion.AllSinsAsideVersion: 7.43.0

Would recommend.I’m a single income house with a small child, ended up having money stolen from my account and didn’t know what I was going to do. I found this app and loved it. The amounts start off smaller and once your payments are paid on time time they increase your borrowing limit, I think the max amount you can get is based on your income. It automatically repays itself from my account so I don’t have to worry about remembering to pay it, it also will let you reborrow the money right after it’s been paid back if you’re debit card is verified, I had to get a new card so that time it took a few days to be able to borrow again because be the payment had to process. 5 days I think. The only thing I would change about the app is that it only lets you take money in intervals of $50 or less and to get the money immediately, it charges you $5 per $50 you take. So I end up having to pay like $50 extra just to be able to get the money immediately. The app does encourage that you tip, but you do not have to..Mandyy lynnnVersion: 7.35.0

IF YOU NEED ADVICE Before getting this appWhen i first got this bank i was excited i was accepted for MoneyLion after i entered all my personal info i was given access to the app they ask you if you want to join the MEMBERSHIP they give you different pay options on how to pay it ,they even ask you to link your bank account you already have . DONT BE WORRIED !!:) they’re a bank they need this stuff to help you operate. You can get access to a 500$ loan . I couldn’t get the loan right away which made me think this was dumb but it said i was on a lock down sorta thing . You have to check into the app every day to unlock the 500$ loan for about 30 days and after it’s GUARANTEED I PROMISE YOU how you spend it is in you just remember ITS A LOAN IT AFFECTS YOUR CREDIT AND HELPS BUILD CREDIT. So the MEMBERSHIP fee goes into your investments account I’ve had this for about 2 and half months and I have 200$ in my investment account from getting 1$ every day i check in the app and i also have a direct deposit set up to my card i don’t have access to instachash even though i do have money going into my account but i know this app is a good way for you to save money in the years coming.Before you downloadVersion: 5.13.0

I love MoneyLion😍I absolutely love MoneyLion it is a legitimate resource for saving and a legitimate source for a loan!! I started using MoneyLion in May and have already been able to save almost 300$ now I know 300 doesn’t sound like much but considering the fact the my savings account would always show zero I count this as a win, also in addition to the investment account, I was able to get a 500 dollar loan the next business day with NO hassle, of course you need proof of income and ID but that’s pretty much all they asked for so as long as you have a legitimate bank account a source of income with direct deposit and A government issued ID you will get a loan!!! And they are easy to payback my loan only charges me about 19 dollars every payday now this app does cost 79 a month but 50 dollars of that automatically goes into your investment account so it’s your money it’s kind of like a forced savings which I don’t think is horrible, and you get one dollar everyday that you login so the app is really free if you are logical lol but other than that don’t be hesitant to give it a try!!! Good luck.TobiasT94Version: 4.5.0

Money Lion ForeverI love the app, all the educational info that is posted for users, the instacash and the shake n’bank features. This is my one and only bank and I love it and I’ll never go with another bank ever again. MoneyLion makes it fun and easy to keep track of everything and allows you to invest and check your credit. The. Best.

Constructive criticism here: I wish the shake n’ bank would let you shake for the month instead of for each purchase. It’s a huge time waste to sit and click and go back and forth for each purchase. Also, just FYI, if MoneyLion is your only bank, and your direct deposit from work is deposited into your account each month, you will not have access to the the credit builder loan. I’ve contacted support and asked about this several times, but the only way it’s possible to get the loan is to change your bank direct deposit to a different bank and then connect that account to MoneyLion. (doing this will then disqualify you from getting instacash though, so pick your battle.) I also don’t want to switch my direct deposit to a different bank. 🤷🏽♀️.LaLoLi20Version: 7.49.1

Free International Money Transfer 💸Enjoy high maximum transfers into more than 20 currencies while saving up to 90% over local banks! The cheap, fast way to send money abroad. Free transfer up to 500 USD!AdvertorialVersion: 7.96.0

MoneyLion: Cash Advance App Negative Reviews

SCAM! Useless Customer ServiceThis app is a complete scam. There’s so many wrong things about it I don’t even know where to start. How about the fact that I turned off the ability for it to round up my charges and make auto deposits yet somehow even though I turned it off it turned itself back on again and started making auto deposits against my wishes now I have to wait a week until they will give me my money back because they made investments I did not ask them to make and they say there’s some glitch. Well there are too many glitches because this keeps happening. And furthermore it won’t allow me to add a debit card and it keeps telling me I need to get a different debit card but I only have one debit card and they tell me that I am wrong. But clearly it is them who is wrong but they change nothing and they admit to nothing. The whole thing is scare me and glitchy and they don’t care to fix any of it because they just keep taking your money. And then they charge you a dollar for the fake investments that you didn’t even want anyways and they refused to refund you any of it when none of it works properly the whole thing is broken. And their customer service does nothing they were repeat the same thing over and over and they say they are powerless to do anything well that is no customer service whatsoever they’re just blowhards and scammers they just take your money and they give you nothing in return it is a lie the whole thing is worthless and just waste your time..AhahebrfiwoVersion: 7.50.0

Double dippers and kinda priceyI use to wanna recommend this app and call it atleast 4 stars due to it being easily accessible and giving me another financial institution to send direct deposit’s plus the extra cash they’d borrow me, BUT these people double dip into monthly payments you may owe if you missed a month rather then sending you a indication. if you attempt to contact them they will tell you their reason and immediately end the chat. The customer service experience is mildly frustrating to deal with because they seem more focused on sucking every bit of money they can then giving assistance (common taking from the poor to make themselves richer). I got a new job and was behind on payments at home and their credit loan plus program but as soon as I got my first paycheck they took half my paycheck to pay back what I owe the same day I was payed almost as if they have been charging my other connected bank everyday since, and their reasoning was I am late on a payment. I had no idea they had the option to take as much as they please which really hit me hard for the upcoming weeks I have to work till my next check. I’ll be finishing the credit builder plus program and immediately getting rid of any connected bank and deleting my account ASAP. It was good for awhile but doing all the extra features was the BIGGEST mistake no way someone should be paying almost 100$ and for me 150$ to use this app. Smh.IllsystemVersion: 7.91.2

Will not help credit run away!!!!I got this app and account as it says if you log in each day you don’t have to pay for the services. I also got the $500 loan to help with increase my credit. This bank only works with a few of the major banks so only my one account that I used for online transactions would work. The major pain is they take 6-7 day’s to process a transaction. It takes 2-3 days before it is taken out of your bank and then some times another 5-7 days to show up on your account as having the loan payment made. I had it set up for automatic payment but even that took 5-7 days and would show that my payment was late due to the lag in the processing of the payment. I contacted there non existent customer service and was sent to there team and services page with zero help. So basically you pay $19 a month to have access to a $500 loan. The loan was easy but the issues with the account and no ability to make payments through bank accounts that do not link through there site such as a ACH or direct withdrawal you can not use checks or anything to make payments and they take so long to clear this app has now actually hurt my credit. 2 of the months they took longer due to the payment coming out over a weekend they had already reported the payment as late before they processed it. This is a scam please do you fall for this like I did. I have paid back the loan and plan to cancel my membership as soon as possible. Also they will not give you back your money in any way..KrisAndraeVersion: 6.7.0

DO NOT BANK WITH THEMLet me start by saying DO NOT BANK WITH THEM DO NOT PUT YOUR PAYROLL DIRECT DEPOSIT WITH MONEYLION!! Let me share my frustrated experience with this awful company my account from nowhere was put on hold they sent me an email to send my documents which I did to retention support only response I got was we will verify your documents within 1 to 2 business days waited till 3rd business give them a call supervisor by name James F guarantee me account would be fixed by today 4/13 nothing yet when I started questioning what's the hold not able to provide me any type of information when I ask them what's the dedicated team number no information provided either when I question them why was my account flag they couldn't even provide me with a straight answer I have sent multiple emails to that dedicated team that has no number or able to transfer and guess what no response either as a consumer we do have financial laws that protects us and for me this sounds like a SCAM I have cancel my direct deposit from my employer due to this matter they basically stealing my money I will be reposting this everywhere possible even to there headquarters I decided one last time to speak with a supervisor and not even a SUPERVISOR can give me a straight forward answer how can you trust a so call bank when they cannot provide any type of information after verifying your identity multiple times at this point i just want my money and there not willing to give me my money back!!.Tynese GonzalezVersion: 7.73.0

Hassles Upon HasslesI liked the app at first, and I enjoy saving money and being able to request a loan when needed.

However, the customer service for this company is pathetic, and so is the system the billing is under as well. The first time I called the person I was speaking to didn't even sound like he wanted to be there, gave me the wrong information that, had I NOT requested to speak to a supervisor (who also sounded bored and condescending) it could have been a choice that damaged my credit.

Today I call, because I'm willing to pay off my loan. Using a bank account takes way too long and at this point, I'm ready to pay off and cancel due to the hold time and the wait customer service has. I finally get through to someone after a whopping 15 minutes (and fake clicking links on the website to contact support) for them to tell me my card is not supported to pay my loan off in full. Correct me if I'm wrong, but the BANK ACCOUNT is literally attached to that card & vice versa, how can one be supported and the other isn't ? The bank account takes too long to clear and it completely ruins the plan I had since I'm on vacation. I don't even want the membership anymore, cause there's way too many aspects to this membership and it seems that not everyone is skilled or knowledgeable on it which makes it even MORE confusing, to then have this issue with my billing I'm completely turned off. Once paid off I'm finished..SYJ0596Version: 5.13.0

They are like a Mommy make over with a ugly soul attachedPoor poor poor service!!! 👎👎👎👎I normally would not do this! But if you loose your card and someone uses it. Do not count on their resolution team to resolve the matter. They will have you waste precious time and not give you a previosional credit. They closed my account without fixing it after I have been a good paying customer to their services. They made me loose a lot of money because my instacash was attached, my direct deposit, I didn’t have access to my funds on a weekend I was supposed to take my kid to Lego land for her birthday!!! They were so inconsiderate by not tell me ahead of time so I can make other arrangements with my employer. Instead my family went the weekend without my pay. And they never fixed that erroneous charge of $300 which cause us to struggle for food during that time. This was a unresolved matter for 3 months, after escalating they close my account without proper notification. They don’t care about their customers at all!!! You would think that higher up will fix, but instead they do the most heartless and upsetting action on a weekend that should have been financially perfect. A company with poor customer service is NOT A SAFE place to be. Poor poor service!!!!! Their app looks pretty, but if you reach out for a concern, they DO NOT CARE to resolve properly causing loss of trust, funds and appriciation to the app. Bad bad actions from Money LION 👎👎👎👎.Customer you didn’t care aboutVersion: 7.83.0

The only way to get money is exploit the contractDon’t pay this app your money ! They have no ability to collect or garnish wages their payday loan is considered a “gift” by law. Look at the borrowing contract, don’t give the crooks in this app any money. Get a payday loan “Insta cash” then after get your bank to revoke transaction privileges from this app. After you get your money, and cancel your membership do not use the app at all. If they continue to withdraw money contact your bank and get it blocked ! Read the contract for the app. They will only bar you from future services they can’t impact your credit or wages. This app is the worst the only services they genuinely offer are better found elsewhere. The payday loans(in which the amount you’re able to get each payweek changes on the daily) don’t after financial stability they just make paycheck to paycheck living way worse. You have to pay a bi monthly membership fee to even access any services in the app! And their credit builder plus loan is a scam! You pay off a thousand dollar loan just to get back 700 a year later later. You can’t even cancel it. Tried canceling and paying off the remainder of my fake loan and the app repeatedly just didn’t let me press cancel. Shameful practices I wonder how this app even has so many reviews and articles about it. Everything I said before is true read up on payday loan apps and the legality of cash gifts to do your own research.GqerezVersion: 7.70.0

Horrible customer serviceLower level agents are worthless, they can’t solve any legitimate issues. Request a supervisor to speak with, be ready to spend 4 hours on hold and not speak with one. Lower level agent will try to setup a callback from a supervisor which is worthless. They will set up a time frame of 24-48 hours for the supervisor to call you back, but the call will not come. After a couple of weeks of requesting to speak with a supervisor, you will finally talk to them and they can’t handle much either as far as legitimate issues goes. Then you request to speak with their superior to try and resolve ongoing issue. Takes another couple of weeks to get in touch with them. You discuss the issue with that person and they inform you they will do some research into my issue and get back in touch with me within a few days. A week or more goes by so you reach out to communicate with the customer advocate you thought was researching your issue to find out after another week or two of the same cycle of horrible customer service to realize that they haven’t done anything into trying to resolve your issue. You communicate with them the horrible customer you keep receiving and the hands of their lack of communication and she makes notes on the account to help alleviate the customer service experience and then you still keep having to deal the same horrible customer service experience.Dylan CaroonVersion: 7.52.0

Garbage app, customer service is trash and clueless on there own productsEver since I’ve been upgraded to the Roar Money account it’s been a nightmare. There’s been issues with MoneyLion in the past but this about does it. I upgraded to this new account and was encouraged to switch all of my direct deposits to it. A few problems with this. One it would not give me the option to make this my account to make my membership payments so last month it caused a missed payment which I fixed by transferring some money over from my MoneyLion Roar account to my old MoneyLion account and did a manual payment to my MoneyLion membership. This month same thing happened except this time even though my old MoneyLion account does expire for over a week the option to transfer from my Roar MoneyLion account to the old MoneyLion account so I could pay off the missed membership payment. So I had to call in and a representative switched the payments over for me to my MoneyLion Roar account and I paid the missed membership payment. I even paid the remaining balance in full for my MoneyLion loan. I was told the freeze on my account was gonna be lifted and than the call dropped. No call back so I called in again and this time I’m being told my account even though paid off is still suspended for 3-5 business days so I’m unable withdraw my investments or apply for a new loan. A lousy experience..Bryan FlorianVersion: 7.6.0

What a wasteI have been using money lion for pretty close to a year. Never had any issues until lately. I contact customer service to let them know that they are drafting my membership fees and loan payments on opposite weeks that I get paid and to please correct it. That was back in October. Never got done. After being charged multiple nsf fees from my bank I called them again, yet they have no record of me calling. I try to look past it cause everyone makes mistakes. I get my direct deposit sent here and that is when al the real issues start. There as too many bugs. I log in ever single day. I never miss. Yet since they had to change my payment dates which they finally did the customer service rep that I spoke to assured me that I would still get my 50 dollars back into my account. Not true. Even though they still took the payment out of my direct deposit the following day ( my direct deposit is set is with them) so they can see my deposits they paused my membership so that they could keep my 50 dollars. As soon as my taxes get here I will be paying off my loan and direct deposit. Too many bugs. Customer service supervisors just lie to get you off the phone. It says that I need to finish setting up my account with direct deposit all the time even though it is set up already. Today it says that it can’t verify my bank information even though they are my bank. Don’t waste your time..Tiffany 76180Version: 5.10.3

Left me with no money 3 days before ChristmasI have had moneylion for years and been very happy with it. My instacash had increased to $780 which I always paid off early when used. All of a sudden 3 days before Christmas my instacash eligible amount decreased to $180! I had been depending of using a good portion of that for bills due to Christmas expenses. After three different calls and being told three different things I was finally told this morning it was because I had an EXTRA (yes extra) $100 deposited into my account December 1st. Even though my direct deposit was the same amount there is a glitch in the system it thinks your deposits are inconsistent..that makes you ineligible for full amount till the next payday January 28th in my case😭 The worst part is that apparently they have been aware of this glitch because it happened when some ppl received an extra govt payment and no one thought to warn customers! I can’t even begin to explain the financial hardship this has created for me. And the fact that there is nothing that can be done to fix it is unbelievable to me. Unless some miracle happens and the system “unglitches” itself I will be closing my account and moving my direct deposit before my next payday. I hate it when I have loved this account so much but I cannot risk another $600 system problem that takes over a month to fix.Sherri226Version: 7.40.0

Poor transparency, poor customer service.I enjoyed money lion for years, until one day out of no where they closed my account. I tried calling plenty of times, no one can tell me why it was closed, and they make it clear I am no longer eligible to open my account, and ALSO I am not eligible to get MY FUNDS back. I have never dealt with this sort of thing where a company, let alone a financial institution can just close an account without reason, and not allow you to get your funds. I feel robbed, and scammed. Worst case is, I also had loans with them, in which I had paid off and taken out again and again, to build credit. Now I am struggling to log in and or link any sort of account to pay those off. It’s horrible customer service on their part. And horrible transparency. Their customer service will try and push you away the moment you constituents asking questions about why they closed your account, and push you away when you ask why you can’t get your funds back. Not in a nice way either, they brush you off like it’s not a normal thing to ask for your own personal money back, and or A valid question like “why was my account closed”.

Beware as this could happen to you, and they will not give you a reason, and they also will not allow you to have access to your funds..Robdfb3Version: 7.82.0

Please avoid and get a traditional bank accountMost traditional banks offer cash advance as well as long as you receive consistent direct deposits… I have had my first ever dispute started with ML I reported an unauthorized charge mind you this bank account is suppose to be FDIC first lie… they are not here to help the consumer it’s strange that they can willingly give away 1000s in sweepstakes but god forbid anyone loses money from their fdic insured bank account they can’t help you… they lie I have proof after proof of their lies I had a agent try to alter and in a no refund policy that is not stated in their terms and conditions regarding instacash payments which I remind you customers have no obligation to pay… I have always paid my instacash payments back and after my money was stolen from my account I paid off my credit builder plus loan to get my money out the credit reserve just for ML to take it and not give it back even though there is no clause in the terms and conditions saying the payments are not refundable and to make matters worst after taking the money and not giving it back they reduce my instacash so that I really have no way to get it back and not once even after explaining the situation have they offered in anyway to help they seem to be one of the companies scared of the big apple and doesn’t care about their pay consumers.Upsetconsumer21Version: 7.79.0

FRAUDS! STAY AWAY FROM MONEYLION!MoneyLion fraudulently opened two separate accounts in my name with two different social security numbers. They opened a $500 Credit builder PLUS loan in my name without my knowledge, authorization, consent or approval. They forced me to pay that loan off even after I filed a police report which backed my identity theft claim, complaints with the CFPB, BBB, The NY State Attorney General’s office, and the FTC. They reported this to the credit report which is how I found out about it. The bank they had on file is not a bank I have ever done business with. They are SCAM artists and they are frauds. DO NOT do any business with them. They are nearly impossible to talk to on the phone, they don’t care that they have fraudulent accounts, and refuse to follow the laws on the United States to correct this.

They owe me a lot of money and they said that they already paid it. That’s a lie. Then they said their “engineers” had to review and release the $375 escrow funds (that I never opened in the first place but was required to pay off) within 5 days, yet the haven’t. I want a refund of all monies paid to protect my credit because they are full of crap. This company is a bunch of scam artists and their call center is based out of Malaysia. They have no regard for identity theft victims or their customers. STAY AWAY FROM MONEYLION! You will regret this!

They need to be SHUT DOWN by the government!.Labs1980Version: 7.4.0

BadI’ve been with them for 6 months started off with 50 dollars then within the month 275 I was at that amount for about 5 months and today I went paid loan off even a day early 304 total for them to have drop me to 50 dollars .... so they claim they can’t see my paychecks it’s impossible you can’t they just deposit the same checks same amount same account ! This is crazy !!! Then the other rep said they r having technical problems so which one is it ?! I’m done with this app ! It’s ridiculous a loyal customer paid on time or ahead of time for them to pull this one right before Christmas at that ... you’ve just lost a good paying loyal customer... I’ve heard others say that if you don’t tip them they do this !!! Well I have tip you guys !!! I’m done with this app !!!! Good luck too everyone who try’s to use them !!!!! You’ll be happy like I was in the beginning till they start with this funny stuff ...!!!! Goodbye MoneyLion ! This app wouldn’t let me post this bad review!!! By the way the reps r clues !!!! Update horrible will ever use this useless app again they won’t even let me transfer money to my debit card but want me to withdraw more money ridiculous never again avoid this crap app it alone wants your money and the reps are rude and clueless never again I’ve been a loyal customer for a few years I’m done.Riverrrrr2Version: 7.64.1

My personal experienceMy personal experience

If there were an option to give money lion 0 stars..I would. I had no problems with money lion up until someone tried to open an account with my social security number. Instead of Money lion making this person verify their identity, they closed my account with all monies I had tied into the account. I sent them a copy of my ssn and drivers license and still nothing. My issue is they do not secure your identity. I can open a Money Lion account right now and type in any ssn, this ssn could be YOUR SSN and just like Money lion will close your account. Anyone can claim to be you. Money Lions Algorithms are unsecured. I am extremely disappointed in the way their “care specialist” are handling the theft of my Identity. This is a weak and fraudulent company. I can open a money lion account and claim your phone number and just like that your phone number is removed form your account. They will not try to reach out to you to verify any one’s information, they just allow anyone to make these changes. I would love to read the response from the company so I can shut them down. I can and will back up any statement made in this post. Money Lion are MONEY LIERS!!! And THIEVES. Don’t trust them with your personal information. It is too easy to become a victim of identity theft with this company..Oh they know who I am!!Version: 7.35.0

If it was legitimate....So everything was totally great, then my monthly payments weren’t coming out each week. I called numerous times the first time they didn’t go through and couldn’t get through. When I finally did they tell me I was in “default collection” just 2 days past my due date because my bank account number to take the payments out were wrong (but not wrong to put the money in my account mind you) so they make up a “new payment plan” and instead of 52 weeks pay off I have now a 12 week pay off as “punishment”. I negotiated to 16 telling him I put the right account number in (he even read off the right number to me) and begrudgingly accepted. Then I wait the next week for the payments to come out and they don’t. Instead I get an email this time (the first time I had to track them down) and it says “broken promises” as the headline and that my account number was incorrect and they couldn’t take the payment out. This was after 56 minutes on the phone (a recorded line) with a rep to fix my “issue” the first time.

I knew the terms and agreements I read it I knew I’d have to pay that wasn’t the issue, but this company is literally pushing people into paying more and lying about how they’re doing it. It’s a shame because if they’d done it on the up and up they could make a ton of money with good reviews and a great business model..DexdaveVersion: 5.8.0

Subpar in comparisonUpdate: I wasn’t impressed with MoneyLion at all. A complete rip off. The latest annoyance with this app is it won’t let you remove any bank account/card information even without a membership. I’ve called you can’t get through and I’ve emailed and of course no response. I would think twice before downloading the app!!!!!

Compared to other cash advance apps (Brigit & Earnin) MoneyLion is a joke. With Brigit you pay $10 a month and I can borrow 250 biweekly. It’s not instant but within a day or two I get the money. Earnin there isn’t a membership fee you just tip what you feel is right ... I can get it into my account instantly and borrow upto 1000 a month. MoneyLion has you pay a membership fee to borrow... 10 dollars ok cool. Then it takes 3-5 days for the money to hit your account. Ok that’s not the quick help you’re possibly hoping for but if you pay another 5 dollars per amount you borrow it can be instant. Ok fine but you’re already losing to the other two apps now. Then right before you get the cash advance they want you to tip. I’m sorry I’m lost what the heck am I tipping for???? I’ve already paid a membership fee and a fee so I can see it before 5 days. Then if you chose not to tip you get multiple other messages about how you need to. If you are looking for cash advances I wouldn’t go with MoneyLion go for the other two..HaldignneskgfVersion: 6.12.0

THIEVES! STAY AWAYThis company is absolute garbage. I took out the 500 dollar loan and paid it off early. I called to cancel my membership and ask to liquidate my investment account. The guy said I will have my money in 7-10 business days. I call them 7 business days later to check up on my money. They say that no liquidation request was made (I made sure when talking to the guy originally that it would be liquidated and in my account in 7-10 business days). So I asked to speak to a supervisor who said he personally submitted the liquidation request and I would receive my money in 7-10 business days. I call them 7 business days later to check on the status and they tell me that the liquidation is in process and the money should be in my account in 3-5 business days. So I wait 5 business days and call today. The guy said that the liquidation is still in process and doesn’t know what is going on but he will send a message to the higher ups to see what is going on. It has now been a month since I originally canceled my account and still haven’t gotten my money. They’re just giving me the run-around like the other reviews I have read stated. Do yourself a favor and stay away from this trash company. I am going to report them to the correct agencies and I am going to take legal action. This is theft. Plain and simple. Stay away..GregfirestoneVersion: 5.5.1

Super excited thus far...I downloaded the app and although there are issues like DL not scanning and the #growyourstack option doesn’t pan a flat surface, I was able to get everything else going. I was super skeptical, ESPECIALLY after reading all the reviews about high interests, unexpected “surprises”, and scams but if you, as a consumer, do you part and actually read a document, you will see exactly what are signing up for. I was approved for the loan at the 5.99%; they don’t even check your credit for it and their requirements for approval are clearly stipulated. I opened up the contract to make sure and I was happy to see that I was set up for payments according to my pay period and at a 5.99% APR. Had I seen something different, I wouldn’t have accepted the loan. I would recommend that you open docs and read them before agreeing to anything. I am looking forward to having the issues worked out so I can take 100% advantage of all MoneyLion’s functionality. Financial stability is very important to me. It is clear to me that MoneyLion knows that there is an enormous gap between basic financial knowledge and healthy finances and they are invested in bridging that gap to help those of us that haven’t made the best “financial” decisions. I will come back and update my review as time passes. I’m hoping to bump it to 5 stars and 2 big thumbs up!!.NadezhadaVersion: 3.13.0

Scam predatory company.So they market as a credit repaid loan company. But what your credit sees is a major risk account. So it won’t help. But forget that. In order to use the so called loans. They not Only charge you for the withdraw. Then they charge a fee. Then they want you to tip. Then even though you make arrangements to pay a loan back. They will continue to hit your account every day. Changing the amounts to reflect what’s in your account or not. Causing more fees from the bank. Then want to know why you can’t pay it back. Well let’s see. You already charged me nearly 100 bucks for the money. Then 10 times trying to get it out of my bank when I said it wouldn’t be there until a certain date. Costing me an additional 350. I get what kind of company this is. But doesn’t change the fact that you guys screw over your customers and just keep doing it. I’m glad it’s paid back now. 250 bucks only cost me 800 to get. Do yourself a favor and use a company like self. That doesn’t purposely try to screw you or fee you to death. I hope after covid. Companies like this feel the fall out the most. Not their employees but the scam artist making the decisions. I only hope they revive the same amount of stress they have dished out over the years.

Run it’s not worth it!.Drewski1985Version: 7.31.0

Can’t Even Create An AccountI have been trying all day. Read all the terms and conditions dotted all of my i’s and crossed every T however I keep getting the same message every single time. “ Oops Sorry we can not create a Money Lion account at this time. Try again later. “ There is no formal customer service for your customers to contact for help with that said I really don’t feel completely comfortable moving forward with opening the account. When I researched the error I am getting I stumbled upon a discussion forum of recent conversations from your current customers that are very dissatisfied for various reasons. Money not received or paid, can’t access their money, app not functioning, debit cards rejected and no customer support. These are much unlike the reviews I had read prior to the attempt at opening an account.. I think in my situation I am just going to be thankful that for whatever reason this app didn’t download and I’m thankful that I stumbled into the discussion forum that I did. I would encourage people that are considering the thought of downloading this app to search out reviews from true customers not reviews that can be purchased. I would also say to the developers that to have a financial app of this type without no support at all is irresponsible on your part as the company..CmkirkpatrickVersion: 7.18.0

Run AwayI have no idea how they have so many 5 star reviews... other than they must be somehow paying people to generate them. This company has the worst customer service I’ve ever experienced. I’ve called them over a dozen times to address issues with my account after countless emails fail to resolve anything. First of all, your emails will be replied to from a generic account so you literally can’t follow up with the same person. Also, no one has ever responded to my replies to a request for more info on an issue. So I will email about something, get a reply, then respond and literally no response thereafter. Every time. Also, calls to sales reps always seem to go well, but when they escalate you may or may not hear back from a manager. I was told that there was clearly no direct deposit pattern even though I have a direct deposit of $4200 every month on the last day of the month happen. How that isn’t clear I do not know. And that was a managers response. The poor people at the call center, good luck if you can find that phone number, are genuinely good people but given no power by a company that screws its customers. Their app is also an atrocious excuse to upsell you on their add partners. You can’t check your balance until you’ve clicked through a bunch of 3rd party offers. Again, run..Dalmralm10Version: 5.20.0

Investigations, Apparently, Never End! Big Money, Lost/Stolen!!!The people at Lincoln Savings Bank will know who this is, if they look in their records, but this is Mel, from Anchorage, Alaska, and there is more than $30,000 locked up by an investigation that begin many months ago, and yet, as Roar Money nears, and my account is closing on September 1, they have refused to tell me when I will have this money released to me, or, where it will go back to, if but to anyone but themselves at Money Lion! Who are these people? Nothing but a pack of thieves? Why don’t they tell me how I can get this money, or even if it’s going back to where it came from? And are they going to try and bill me for the $9000 plus that was used before they did so? It was a total mistake to ever have an account at this bank and Money Lion! I certainly will never do so again! This is to let all of you out there know, what a pack of thieves this bunch is, and they will do nothing to rectify any situation, no matter how many times you asked their support for any answers! Whether by phone, or the support site and getting a ticket, they do still refuse to give me an answer! I would say that some or more of you, can expect the same, and I would suggest finding a safer place to do business with!!!.Bruce MacFergusVersion: 7.6.0

InstacashLet me start off by saying I’ve been using this app for almost a year and the first 7-8 months were great, but then they downed my limit from $540 to $285 and when I called they said it was a promotional thing to keep customers happy for a while. Which is crazy and put a bad taste in my mouth, then the week after I called I was about to cancel and they upped my limit back to $540 then a week later up to $640 which I never use the entire amount but is always good to have in case of an emergency. Now they downed my limit again saying they cannot detect my qualifying income which is crap because I have the same paycheck every week and it hasn’t changed and when I called the gentleman who I spoke to said it was because of my bank and it was my banks fault because they still see my income but my account was switched from checking to debit which made no sense the way he was explaining it to me because my account is linked they definitely get their money back every week and my debit card is also attached to the MoneyLion account. It’s so inconsistent and the answers they give me when I call are bogus and don’t make any sense whatsoever. I’m going to call again today to see if I can resolve this issue, if not I’m deleting the app..Wade_G_88Version: 7.63.0

Honest reviewI think most people who rate this app 4 stars or more are only referring to the Loan they just received and how quickly they got the money, which I would say is understandable. But after months of being a member with MONEYLION, I have experienced a troubling amount of bad customer service. On top of that, it’s not easy to reach them if you have any issues. For some reason they can’t even call my actual phone number and I have to use a Google Number for verification that I set up. When you finally can reach them, it’s never an American, which is cool. The only problem is that while I can understand every they say, they can’t under me. It’s super frustrating. But most importantly, I’m still getting charged after I’m no longer a member. Guys, customer service is PRICELESS. The most trusted companies have that part taken care of. But not MONEYLION. If they happen to double charge you or claim that the bank won’t let them take the money out even though money is clearly there, good luck with having that issue resolved.

UPDATE: They posted a link to schedule a phone call from their customer service team. Tried that twice. No call from them. And their still attempting to charge my card for a debt that’s paid off already. Smh...BassbrothaVersion: 6.19.0

Worst Loan EVER !!They approve you for credit builder plus, but give you only a portion of that money and keep the rest in “reserve”. Once you pay the WHOLE $1000 plus interest THEN you can get what they’re holding from you. What they dont tell you is it takes 5 business days to get that money transferred after you pay off your loan which takes 5-7 business days to clear might i add before the loan is paid off. They hold your money for 2 weeks after paying off a loan. You email them and no one can give you a good answer. Then they charge the membership fee of $4.6 weekly if you have a loan out with them (its required). Ive never had such difficulties with a loan company actually giving me my money. I paid off my loan going on 2 weeks and i have yet to get the money i had in reserves myself. If you need a loan. Go somewhere else. Anywhere else. They couldnt possibly hit you with this many problems and fees.

Update - Called to ask why i STILL dont have my money from my reserve that i paid my loan off 2 weeks ago. Their response was that cancelling my MoneyLion Plus ($4.60 weekly) slowed down the process and now its going to take ANOTHER 2-4 business days to trasnfer funds. Ive NEVER heard of a company coming up with so many excuses to hold on to your money. Once again DONT GET A LOAN FROM THEM!!!.Romo210Version: 6.15.0

Great informational App, LITERAL TRASH as a bank. Using Dave or anything else here on out.Image being told by a “top tier” banking application that had your social, phone number, email, AND banking information that you are in fact not the person you claim to be. MoneyLion displays itself as the go-to app for all of your banking needs, but increasingly falls short of expectations. After being denied the “Instacash” offer, I was told I would have to wait 7 days to even be approved for cash advances, but it failed to tell me where I went wrong. Was it my lack of information, or did something go wrong with the bank it already approved? I’ll never know, and with my bills coming up in 5 days, it’ll be too little, too late. Image facing punitive measures for a failure on your banks part. If this were any other bank, I would withdraw my money, and take it somewhere else, so that’s what intend to do. If you can’t help when you’re needed like you said you could, what is your point of being on my phone? Oh AND you have to pay 10 dollars, on top of getting only 50 for the first advance, so you basically only get 40 dollars. You’ve got your policies OUT OF ORDER. I can’t wait for something better to come along and destroy you because this is false advertising / A lie by omission at its finest. You’re useless..Sir Christopher CurryVersion: 6.5.0

Fake it till you make itAt first a lot of the options provided to you seem really attractive at first and they offer cool things such as points for having a simple checking account. once you actually have the app and accounts with moneylion it feels like you're being neglected as if there's no one there to assist or help you when the app doesn't work as intended (which is a majority of the time) i've tried doing simple things such as withdrawing a simple $50 from my investment account. It always denies the request and says try again later, and i've been trying for weeks now while they've been syphoning money out of my bank account for plus membership. when you call support you'll be on hold for a good 45 minutes until you get a human if the automated system doesn't hang up on you for selecting certain options as it did when i called in 5 times. Live chat seems to be hidden on the website as if they don't want you to find it. Whilst also having multiple customer service numbers to almost seem it's more of a labyrinth of hoops to jump through opposed to actually helping you. Save yourself and don't fall for the intriguing offers and rewards because once they snag you as a client they'll ignore you as if they don't value you using their services..SynkixVersion: 5.19.0

Removed my Bank after almost a year of using the appI started with MoneyLion almost a year ago. Was smooth signing up. Linked easily to my bank. Was able to borrow a large instacash amount. Everything was great. Then one day I started getting messages I needed to link my bank account. I was confused because I was linked. So for the past few months, I have continued to try and link my account. It shows linked in the accounts menu, but my amount I can borrow is still almost half of what it used to be. Customer service said that Plaid doesn’t recognize my routing number any longer. So I contacted Plaid who said that wasn’t true. They show I am linking every attempt to moneylion. So last night I contacted moneylion customer service again, and they told me that it is MoneyLion that doesn’t accept my routing number any longer, but could not tell me why and stated that no one at MoneyLion could see more than her. Everyone has the same access she said, so no one would be able to tell me why that happened. I am extremely disappointed. This was a great app. It’s sad that they did this. The customer service rep said to change banks. I would have to change so many things there is no way I will do that. What a let down!.JohnMc70Version: 7.52.0

Payoneer 💰Payoneer is an online payment platform that lets you transfer money from any corner of the world! A best and must have payment service for every blogger, traveler, freelancer, affiliate marketer, consultant, virtual assistant, business person, online sellers, and receivers. Earn $25 for free by joining Payoneer. Sign Up Now!AdvertorialVersion: 7.96.0

MoneyLion

MoneyLion