Credit Karma, Inc.

Credit Karma, Inc.Intuit Credit Karma Customer Service

- Intuit Credit Karma Customer Service

- Intuit Credit Karma App Comments & Reviews (2024)

- Intuit Credit Karma iPhone Images

Get everything you need to outsmart the system with Intuit Credit Karma:

• Insights: View all your linked accounts in one place and uncover new ways to improve your finances.

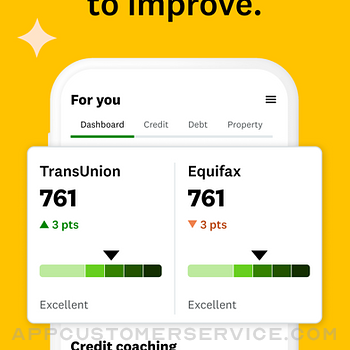

• Free credit monitoring – Get alerted when your score changes, learn what affects your credit scores and get tips on how to improve.

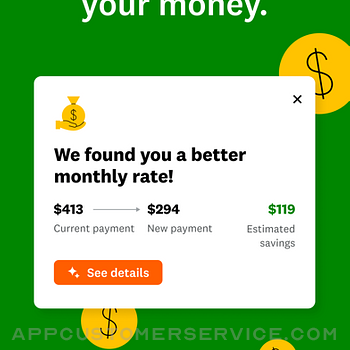

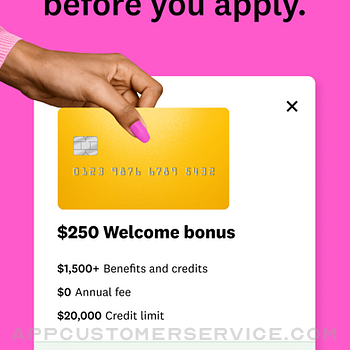

• Advanced Cards and Loan Marketplace: You can find the best credit card and personal loan offers for you and see the specific credit limits, exact loan amounts and rates you could get approved for.

• Net Worth: Track your net worth, monitor your categorized monthly cash flow, find opportunities to save money and learn how to navigate complex financial decisions.

• Credit Builder*: Boost a low score by an average of 21 points in 4 days.**

• Checking: Direct deposit your paycheck into your Credit Karma Money SpendTM account*** and you could access your paycheck up to two days earlier.****

• Drive Score: With a good drive score, you could save big on car insurance from a nationally trusted provider.

And much, much more. Just simply download the app to get started.

DISCLOSURES

*Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

**A connected paycheck or one time direct deposit of $750 is required for activation. Credit Builder plan is serviced by Credit Karma Credit Builder and requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan.

***Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply.

****Early access to paycheck is compared to standard payroll electronic deposit and is dependent on and subject to payor submitting payroll information to the bank before release date. Payor may not submit paycheck early.

Some screen images are simulated.

Loan services offered through Credit Karma Offers, Inc., NMLS ID# 1628077 | Read licenses at https://www.creditkarma.com/about/loan-licenses | California loans arranged pursuant to a California Financing Law license.

Insurance services offered through Karma Insurance Services, LLC. CA resident license #0172748.

Intuit Credit Karma App Comments & Reviews

Intuit Credit Karma Positive Reviews

Need more credit offeringsI LOVE Credit Karma! I only wish they had more diverse credit card option. As my credit score gets better, I keep getting offers from Capital One. I have two cards already and when I accepted an offer they (Credit Karma via email) recently sent me, I was declined based on having too many Capital One cards. I have no problems with my Capital One cards, the app makes it so easy to manage and pay my balances. The in app reviews seem to be spot on so make sure you take the time to read them before accepting offers. They seem to be partnered with a company that offers credit but the reviews are pretty much “consumer beware” I’m glad to have Capital One in my wallet so if your looking for a go to card with awesome reviews on rebuilding your credit, they are a good place to start. I recently also started receiving auto financing offers from a company that basically sells their cars via a vending machine concept. The reviews are absolutely horrible and the cars are severely overpriced. It is my opinion that some partnerships are just not a good fit for Credit Karma. Someone with bad credit would have a better chance of getting a better deal at a lemon lot or car auction. Credit Karma has helped me set reachable credit goals. I just wish there were better in app credit offerings as ones scores improve..Version: 5.79

Not impressedI used Credit Karma maybe once every few months. It isn’t an app I need often and I thought things would change when I heard I was being forced to abandon an app I’ve used for decades to switch to this. Since CK is only bringing features every other generic spending app will bring as well, I have to say I’m confused. A lot of people used Mint for the budgeting features and CK doesn’t even have them. On top of deleting my favorite features, I’m now getting 3x the amount of emails from CK asking me to check back in, to finish this or check something else out. I am not interested. Everyone knows what your app is for and what it does, and the “best of Mint features” you are adding are *not* in fact the best features, they are leftover functions that again, any basic spending app will have as well. I have had to continuously unsubscribe from different CK emails and I’m considering shutting down my account entirely at this point. I am so incredibly disappointed, Mint was an incredibly original and useful app. Now I have CK that will tell me what car insurance and credit card is best for me. I work from home and don’t have a car, and who buys insurance through a phone app? Did it not occur to whoever made this setup that people used the original Mint features to help improve their financial life, not find ways to open more credit cards or lines of credit that will make their credit score worse?.Version: 24.4.3

Great CompanyI've been using the Credit Karma app for a few months now and I have to say, I'm thoroughly impressed. The app provides me with up-to-date information on my credit scores from two of the major credit bureaus, as well as helpful tips and suggestions on how to improve my creditworthiness. I also like how the app sends me alerts when there have been any major changes to my credit reports, which gives me peace of mind and helps me stay on top of any potential issues. One of the best things about the Credit Karma app is that it's completely free to use. I never have to worry about hidden fees or charges, which is a refreshing change from other financial apps I've used in the past. The app is also easy to navigate and use, even for people who may not be very familiar with credit reports or financial terminology. Overall, I'm very happy with the Credit Karma app and would definitely recommend it to anyone looking for a reliable and user-friendly tool to manage their credit. Whether you're looking to improve your credit score, keep tabs on your financial standing, or simply learn more about your credit reports, the Credit Karma app is definitely worth checking out..Version: 23.17

Inflated Credit Scores BewareI have been using Credit Karma for the past three years and Credit Karma is constantly indicating that you qualify for a personal loan that can save you interest. It states that you can check now with no impact on your score. Both scores on Credit Karma shows 800 plus respectively. After applying you receive multiple email notifications and regular mail indicating that you do not qualify for lack of credit, insufficient credit activity and history etc.. In addition, both credit agencies that Credit Karma shows/uses have my credit score showing 90 points less respectively. I know in their verbiage they indicated that each agency uses it’s own scoring system. My concern with Credit Karma is that it is misleading when it comes to displaying accurate credit scores and it appears as if scores are inflated whereby consumers can feel that they have good scores to apply for products being offered on Credit Karma. If you are going to collect our data and provide misleading scores to create a false positive for us to apply for credit/loans whereby the advertisers will pay you then you should be upfront and truthful with your credit scoring. Be ware of the inflated credit scores on Credit Karma..Version: 5.78

Credit karma is a must!!I can’t say enough good things about credit karma. Having the accessibility and visibility to my credit report and associated factors allowed me to take control of my debt and actually get on top of my finances. Plain and simple. It’s extremely hard to understand your financial position without having the full picture in place, and credit karma provides that full picture in an easy and intuitive interface. When I first started using credit karma, my credit was in pretty bad shape. Credit karma taught me the impact that certain factors have on my credit and provided the guidance I needed to focus on the factors that have the most impact. I’m fortunate to say that my credit is excellent now and I’ve always recommended credit karma to friends and family that have expressed concerns about their own credit score. When my younger brother was thinking of buying a house to start his life with his family, he didn’t know where to start and had no credit to his name. I turned him on to credit karma and within a year he was able to establish enough credit to get approved for a mortgage loan. If you want to get serious about your credit score and need some guidance, credit karma is your friend!.Version: 21.10

If you have bad credit please readI figured I would write a review, I normally don’t do this. 5 years ago my credit was so bad it rated at the lowest it could possibly be. In fact it was likely below the lowest rating. I got this app and finally I learned how credit worked. Prior to the app I had no clue. I immediately started making the suggested changes. This app helped me understand how Credit works and what you can do to immediately take action. Within a month my score increased. It was still terrible BUT I saw it work. Within a year I moved up to Fair credit, I never imagined I would even get that far. It motivated me. So I kept on using the tools provided. My credit was so bad it did take time, however as of today I have excellent credit at nearly 800. I no longer had to search for co signers or be concerned that I couldn’t get a loan if I needed it. (My Fico score is also excellent). Had I not bothered getting credit karma because I thought I couldn’t fix it I would have still been drowning in bad credit. If you think you can’t fix it and your credit is so bad it can’t be repaired you are wrong. If I could get out from under it so can you. Get the app. It works..Version: 23.43

GIVE IT A TRY!I’ve always heard people say this isn’t real. It doesn’t work, go pay for someone to “fix your credit”. I have been using CK for almost a year and they really help you understand credit, advise you on what to do, gives you suggestions and it has helped me raise my score by almost 70 points. My score had tanked because I lost my job, made some car payments late and got behind a bit. It helped me keep track of my payments and also allows you to dispute information that isn’t correct or is outdated FOR FREE! I was even approved for a 1000 credit card line because of the work I have put into rebuilding my credit. I really wish they started teaching this in 8th grade and carrying it into grades 9-12. I never knew anything about credit, credit scores or how it truly affects your financial health. My goal is to buy a home with land, and I see that dream getting closer and closer. Thank you CK for offering the tools to help people and being genuine about it because not everyone can afford a $100 payment monthly to do something you can do on your own if you are literate and learn how to control your credit. Take back charge over financial well-being. I have!!.Version: 23.33

Just Wow 😮Credit Karma is phenomenal!! Let me just start there. Ever since I’ve downloaded the Credit Karma app through recommendation, it’s been one of my greatest habits. It makes it so easy to stay on top of your credit score, watching for increases, decreases, hard inquiries, new credit accounts, and settling disputes or debts of formerly delinquent accounts- Keeping a better score has become effortless at this point🙌🏾🔥🔥. Like my score has so significantly improved since I made Credit Karma the watchman at the door of my credit house!! It’s amazing! Just prepare for times when your score decrease because that will happen, that can be attributed to life and no fault of the app- However because you’ll be so accustom to you score increasing, due to the efficiency & assistance of Credit Karma, it will be emotionally unsettling. Enjoy the app, and treat the person that recommended you to Credit Karma… Trust me, you won’t thank them enough( you also should recommend the app to others, so you can be a part of the Credit Karma! You’ll get several of thanks & applaud for just referring them lol). All thanks be to the Most HIgh God and my lovely wife that referred me. You guys are awesome!!! 👏🏾.Version: 23.16

Welcome to Your Existential CrisisOn the one hand, this app does a great job of helping you build your credit score. On the other hand, it just kinda emphasizes how dystopian and ridiculous this mandatory-participation credit score game is. Why are we allowing these corporations to place our ability to access basic human necessities in a chokehold based on things like, oh no, you used 31% of your available credit limit and not 30% (even though you pay it off entirely on a monthly basis) so now we’re going to drop your corporate-sponsored grade point average that determines whether you’ll be allowed to live inside? Try harder next month! And like the worst App Store puzzle game of all time, this game also requires constant attention and monitoring that is, of course, uncompensated time. No gold coins for you! Also the chat bot auto fills your questions for you, so you never get to ask questions like, “why do these corporations exist in the first place?” “What even is the origin of credit scores?” Or even “Who voted that these corporations get to control our lives in ways even our government won’t, isn’t this supposed to be a democracy?” So yeah, this app is great but also… help?.Version: 23.9

Complete game changer !I received a nice amount of money from my father Christmas, and I had credit card balances all over the place! My boss loves credit karma and told me to check it out. This is the most amazing, amazing app I have ever come across in my entire life. Not only did it help me get my balances lower, by showing me my credit score report. The simulator showing if you pay certain cards down what your score will be is honestly a life-changing component. It also help me find unclaimed money without me even asking, and then I was able to get a point added on to fix my credit score. If you’re looking for a car, a home or personal loan credit karma is truly your best friend! I could not live without this amazing app. The fact that it is free is incredible! Do yourself a favor and all your friends and download the app it will truly be a game changer in your credit and credit card personal loan car loan history well done guys well done! Oh one last thing, the positive emoji‘s and telling you great job is really exciting even at my age! Get credit karma now! Thanks guys. Make sure you check your score with a different source tho , because my score was way lower with credit karma than it should have been..Version: 5.6

ConfusedI thought uploading credit karma would be a good way to learn, monitor, and work on improving my scores. I’m just confused because neither Transunion or Equifax track your exact information the same. Transunion has a lag time in reporting updated accounts. They don’t seem to track all of your accounts and they definitely take double the points then they give. Hence the difference in scores for me. Sad part is lenders love Transunion and probably for that reason. Just Sad. Equifax I do like but today they informed me an account closed. Well this closed account was a 10 year student loan that finally has a zero balance. I never in the 10 year paid it late. Well today because of the closed account my score dropped 3 points. How can a system know every bad thing BUT not a good thing. How do I loose 3 points for reaching zero balance and finally having a closed relationship with a Student loan. For anyone paying off student loans that’s cause to celebrate not be punished. I can’t know how to be better at understanding if they are not consistent with reporting. What I learned with tracking? 1) They slap you on the hand for every single thing. 2) I’m not their client..Version: 21.9

A Game Changer!This app is for anyone that is serious about improving their credit. This app increased my credit score dramatically after a few months because they make it easy to dispute derogatory items. They also give you recommendations as to what you need to do to improve your credit score like paying down balances etc. I made the mistake of downloading another popular credit app through Experian and that was a big mistake. It gave me a credit match with a credit card that it claimed I was likely to receive an approval with, so (as the company claims), I could “apply with confidence”. That was completely false! I was declined for that card and it left a hard inquiry on my account which dramatically affected my credit score. I will never trust an app like I trust Credit Karma. Credit Karma will allow you to be matched with credit cards that you are likely to be approved from plus, the credit card companies will check your credit without doing a hard inquiry and allow you to see if you qualify without negatively effecting your credit score. I seldom do reviews but I this time I felt it was necessary to give Credit Karma the ‘credit where credit is due’..Version: 5.54.1

A Really Wonderful and Robust AppI mean honestly, Credit Karma is the perfect financial tool for everyone, whether you’re just opening your first bank account or you’re a vet that just needs a quick glance at your current credit health. Pros: -Check your credit for free -Get an extensive yet easy-to-follow look at your credit health and the things affecting it, both positively and negatively. -Get helpful suggestions for increasing your credit -Equally helpful credit card, personal, home, and auto loan recommendations -You can do your taxes for free or for a small fee depending on your fiscal situation -You can open a checking and savings account for free. These accounts have no fees. -Amazing interface/UI -MANY bells and whistles, incentives, etc. The only suggestion to improve this app I have is that in the banking section, you show the new balance after each transaction in the activity tab; that is, when a debit or credit is made to the account, you show that along with the new balance it creates right under it. Take an example from the BofA and AMEX apps. It’s more transparent and helps to manage budgeting and such. Credit Karma is one of the few apps that does it all AND does it all really well. Thank you!.Version: 22.22

Mostly helpful but there are a couple of annoying things1) I wish they’d change the update note. Every update says it is “updated to include” the same exact thing. It makes it sound like they keep forgetting to actually include it in one update so then the next update says it is included, oops they forgot again, lather, rinse, repeat, ad nauseam. Sort of like if saying the latest iOS update now included some native app that has barely changed since iOS 1.0 like Clock or Calculator or Phone. 2) I wish there was a way to turn off the thing that keeps asking me about my finding out my driving score. I do NOT drive. So the whole save money on car insurance stuff is moot. Just let me disable that. I’d give the app 3.5 stars if that was an option. Edit: someone at CreditKarma must have read my review, because they finally got a sensible update note instead of the one promising they had now added that same thing they now added last time and many times before that. Still not going to give Transit app a challenge in the best app update notes, but greatly improved. Give me, who does *not* drive, a way to opt out of the app about if I want to know my driving score and maybe I’ll add a ⭐️..Version: 22.46

REAL RESULTS, POSITIVEOnly one time before have I been so impressed, enough so to take the time to leave a review instead of only rating. Having this app is helping me improve my credit! I have been using it for 9 months, and my results are increases of 18pts last 3 months, 36 pts last 6 months, and 68 pts total increase from what my score was 9 months ago when I started using the app! Before, I was like the commercials letting my credit run wild with me completely ignoring it, rarely thinking about it. But now, the app is so easy to use and convenient, I click on it maybe once a week or every other week, take a few moments to review it, and check my new higher than before credit scores. I like seeing when something on it ages and comes of of my report or is about to come off. I’ve also been able to find charges negatively effecting my credit that I am about to call the creditor and inform them of mistakes of billing me instead of our health insurance company. I like the praises the app gives me for doing well with my scores. Thank you so much, credit karma! Soon I will be able to buy a house with a low APR, instead of being trapped in a long term high APR loan!.Version: 5.39

Credit score !!The credit score ratings are old and outdated information that is at least 3 months old !! I had credit inquiries almost a year ago that are still being used against my credit scores ! I hope that by November that will be eliminated and no longer be a mark against my credit!! They continually are sending me messages to get new and more credit cards which makes me wonder if the recording agencies get a kick back from the credit card companies!! I refuse to over extend my credit allowances for anyone’s gain or profit!! Especially when they want me to get a credit card or personal loan for an interest rate that’s higher than I am currently paying!! Seriously ??? My credit is good because I manage my credit, my money, and my future responsibilities appropriately!! I always have and I always will !! Period !! So, as licensed credit reporting agencies ,they should be giving good credit advice and guidance to the people!Especially the young people just starting out and need guidance on how to use their credit responsibility and to not ruin their lives by over spending!! That’s called leadership by example and education!! The future leadership of our country is the elders responsibility!! Grasp that and follow through !!!.Version: 23.39

AuthenticI am grateful for credit karma. Although credit scoring is highly confusing to many, many people, and can be frustrating, being a mortgage underwriter, I do understand that there are different scoring qualities that affect different finance options differently. I do feel like this could be, and should, be explained better, via Credit Karma, without having to dig foe the information. Perhaps associate it with the home page of credit karma, titled “Credit Score Differences - It pays to understand this aspect better.” - so that individuals realize, first of all, which score auto populates when you open credit karma, and secondly, you should list the different scores, as they are associated, so that if someone is applying for a mortgage loan, they have a clearer picture of their score, for that particular product. Or auto insurance, or a personal loan, etc. Other than this issue, which has been an issue for many many years, I am completely satisfied with Credit Karma and appreciate the sincere, authentic, level of security and customer service that you all provide. Respectfully, Terrie Gentry (Fka Terrie Waddell).Version: 21.19

Free credit score! Plus tips to Better ItI had been paying for my credit score through experian until someone else told me i could get them for freeeeee. I canceled my experian and just kept credit karma. I have been working hard to better my score and honestly credit karma has help. The showed options of cards and the chances that i would be approve if i applied. I took their advice and was accepted now i just read all tips that pop that can help me get a higher score. I started off at 520, had 480 when i first started on Experian. Im currently at 684 and ive only had credit karma for 3 months. Honestly if anyone is wanting their score for free. Go to credit karma. Also just a note experian would show me all 3 bureaus that gave me my scores but kredit karma only shows transunio and equifax. On experian they also have the boost option where you can litterally raise your score by reporting on time utlity bills, phones bills and bank account. Also your fico score on experian. Overall really happy with the change. They can also give reminders on your cara registration. If you plan to buy a house what you must do...etc a lot of information that everyone should know.Version: 5.85

Camarota’sI love my Credit Karma’s app, it’s part of my everyday life, I can’t imagine not having my credit karma app, it’s helped me so much in watching my credit, it tells me what could help me, and I can see if there are things in my credit reports that may be fraud, I found the app after I was a victim of identity theft, something very difficult to live through, I strongly recommend those who don’t have credit karma to give it a try, and browse the app to everything they have to offer for free and see how it can help you improve your credit and dispute something in your credit report that doesn’t belong to you, you’ll see your credit score rise in this app as you use all of the free options, and access that they have, so if you don’t have credit karma, I strongly recommend that you give it a try and use what they have to offer, you will see the difference in your credit therefore a difference in your life, someone once told me,” you can be poor, have no money, but if you have good credit, you’re rich”, I never forgot that and I found that it’s very true, thanks to credit karma, I’ve come a long way in bettering my credit. Thank you Credit Karma..Version: 5.39

I Love Credit KarmaI can’t tell how much I just live CK! Honestly, is so so so much better than dealing with massive 20+ page reports from the credit bureaus. CK is user friendly and I can see my whole credit profile in one place. If they would and the other credit bureau and even business credit profiles that would make them even better. Since finally downloading the app and creating my account my credit score has resined. I’m still a long way away from where I wanna be, but baby steps. As I write this (Jun 24, 2018) I still need my new car to be reported and get rid of my ugly 24% interest rate and upside down car balance. My new lease and 0-6% interest rate should jump my credit scores up significantly and by November of next year my nearly $80k student loan debt will drop off too! Well at least that’s the perceived idea anyway. My credit is on the rise finally and after 7 years of under bankruptcy and years of financial mistakes (no credit cards) and debts keeping my credit down, I’m now on the rise and thanks to Credit Karma, I’m finally doing and learning who to improve my scores and stay out of debt and bad financial decisions. Thanks CK! Love for real!.Version: 4.39.1

It’s good but not perfectI only switched because Mint was going away. Overall, I like Credit Karma and it has some positive features especially Credit Score & Report. However, it’s missing one key thing…. I CANNOT edit the date of a transactions under Net Worth . Transactions can be take days to Post (especially on weekends) and then it shows up in the wrong month and messes up that month’s calculations where I had budgeted the funds. CK already lets me edit the category which is a must but please developers let me edit the date too!! What I like most is that Credit Karma simply shows overall how much you spent by category, how much you earned, and what’s left over at the end of the month. Again coming from Mint I had a bunch of custom categories but I don’t miss them (to be honest it’s simplified my life to have less). I also had rules to remember merchants to be recategorized but that didn’t always work anyway. I also had a budget tool but I was constantly shuffling funds (i.e. I spent more at restaurants so had to reduce shopping budget) so wasting time. I don’t miss mint too much and I’m happy with CK but not being able to edit the date could be a deal breaker for me..Version: 24.4.3

Great Credit Monitoring and Management AppGreat credit monitoring and management app. I only wish they partnered with Experian for a full experience. However I have a feeling that’s Experian’s refusal to work together for the greater good of the consumer. Anyway, my credit improved using Credit Karma. I used their recommendation and approval odds to apply for a credit card. I was approved (to my surprise since my credit had been jacked up since I was 18 - my mom told me don’t max out my first credit card but didn’t tell me why). Anyway I was approved for $500 to start. Over the next two years my limit was increased to $5,000. I appreciate Credit Karma being free. If they ever offered a paid subscription or paid tools, I would DEFINITELY pay - and I don’t do subscriptions. been jacked up since I was 18 - my mom told me don’t max out my first credit card but didn’t tell me why). Anyway I was approved for $500 to start. Over the next two years my limit was increased to $5,000. I appreciate Credit Karma being free. If they ever offered a paid subscription or paid tools, I would DEFINITELY pay - and I don’t do subscriptions..Version: 21.3

LIBERTYCredit Karma has been an AbSOULute GODSEND!!! Credit karma helped me discover a $20,000 DEBT(reported as a charge off)…FRAUDULENTLY reported. The lender reported a… $20,000 DEBT-CHARGE OFF(reported AUGUST 2022)…while the vehicle was STILL in my possession(prior to ANY notices). The vehicle was not repossessed until January 24, 2023. $16,000 CASH was put down day of purchase. I had even made payments September, and double payments October. The lender accepted the payments while too…my online account reflected a completely different status.I had ZERO KNOWLEDGE when making those payments and still having the car… that the lender had reported a $20,000 CHARGE OFF, in August of 2022. The dealership-lender have created an ABSOLUTE DISASTER. It’s the most CHAOTIC and DISGUSTING experience, I’ve experienced as a consumer. Words are not able to express the ANGUISH , DISTRESS & TRAUMA their… ill doings….have caused me. The vehicle should have been, PAID OFF, in full…LONG AGO. The dealership led me to believe, that I was signing for/put into a $10,000 LOAN after having put $16,000 CASH DOWN. if not for Credit Karma, I would not have discovered the ADDITIONAL FRAUD. I Thank God for Credit Karma 🙌. ~Grieving Consumer.Version: 23.17

Transunion only now. No longer useful.I’ve used this app for several years and while entertaining, its usefulness has always been limited due to the scores you see being significantly higher than the real scores a creditor or a new potential lender sees and uses to determine creditworthiness and interest rates. It’s been a good way to get a vague idea of ups and downs in your teal scores based on new accounts being reported or items falling off etc, but when you are given a “score” that is 40-60 points higher than reality, the tool’s practicality comes into serious question. Additionally, the app itself advertises in its fine print that its primary function is to expose you to new credit cards that they want you to apply for so steer clear of the “recommendations” to open a new credit account with its advertisers. Finally, Credit Karma has never offered access to an Experian score in the time I have used it; only Transunion and Equifax and now, Equifax has pulled out so it’s 50% less useful than a few weeks ago. Not worth the memory space on my phone anymore..Version: 20.51

Best App to Keep Your Eye on Your CreditCredit Karma does a fantastic job of helping you to track changes in your credit report. There are tons of other apps that do similar things and I have tried many (Credit Journey is one example that comes to mind) but none I’ve seen has been as complete and polished as Credit Karma. The App is very quick with updates. I have received notices almost instantaneously when an inquiry has hit. The interface is intuitive and easy to navigate. I love the app for that and use it regularly. Just one word of caution: do not dispute an inaccuracy through Credit Karma, submit the dispute directly with the relevant credit bureau instead. It is easy for things to get lost in translation and you may end up with an unexpected outcome. In my case a mishandled dispute dropped my Credit Score by 40 points. When I contacted the credit bureau they told me they couldn’t fix the issue because the dispute was not registered through its system. Other than that little snag, however, the app has been awesome. Highly recommend using it for monitoring your credit report activity..Version: 5.26.1

Has evolved into a mega appI’ve had Credit Karma on my phone since it first launched. It was useful then for tracking my credit score. But over time the developers have repeatedly added new, impressive functionality and services that kind of have blown me away. For instance, today I enrolled in Karma Drive, which will track my driving habits for 30 days and then advise me on car insurance that could hugely reduce the cost. It’s also tracking the market value of our two cars, as well as the equity we have in our house. It now strategically advises on what debt to pay off to raise my credit score, and to what amount we need to lower our credit card debt in order to refinance our house. And the new services keep arriving every update. From the user experience side of things, it is beautifully designed and has excellent usability - and that comes from a software interface designer (me) - and has clearly been thoroughly vetted for issues and bugs and simplified to the extreme. All in all this app, and company, deserves 5 stars for effort, expertise, design and value..Version: 21.32

Fraudulent Debt on my credit reportTheres some crazy debt on my credit report. I found out when we went to re-fi our home. I have called this cell carrier about 2 yrs ago explained Ive had Verizon over 6 yrs+ and do not have anything with them. They completely just didn’t care & refuse to remove unless I pay them over a thousand dollars saying I even have equipment with them. Ive never left Verizon. Unfortunately because of this fraudulent debt on my credit we had to pay a higher interest rate on our mortgage. I never knew Credit Karma had assistance phone# people can call when another party has your SS# & has put a negative debt against you on your report. Yea Credit Karma! Oct 5,2021 I spoke with Keith a very nice gentleman who's going to handle my dispute. Now it can take up to another 30 days & I don’t know If this cell carrier will cooperate with Keith since they have ignored all my attempts to remove the debt I never occurred. But just knowing Credit Karma is trying to help makes me feel like someone is listening to me. Im almost 70 yrs old and this is very frustrating. Not to say this report on my credit has hurt us financially..Version: 23.2

Be CarefulBe very careful when making decisions using Credit Karma and there are much better credit guidance apps out there. I noticed a message from them the last couple of months saying lower your car payment with these loans. When I looked closely at the terms I could get a loan with a slightly lower interest, but it only lowered my payments with another 72 month loan effectively extending my payoff time for two years. When I looked at the loans closer to my 46 months left the monthly payments actually increased or were the same. Also be aware that Credit Karma is good at giving you an instant snapshot but they do not give you your FICO score which is what really matters for things like home loans and auto loans. Your FICO is not necessarily the same as your combined credit scores. I’ve also noticed that they keep pushing high interest credit cards when I qualify and have cards with a much lower interest rate. I like this app as they can give you a decent snapshot of your credit but closely scrutinize all offers they give you. Check other credit building apps and closely look at the details. The details really matter when you are talking car and home loans..Version: 22.44

Love this app - so much helpBefore I go into the LIKES of this app, I just want to note the DISLIKE. It only shows 2 of 3 credit agencies. Would be a PERFECT app if they added all 3 agencies. I like that there is so much information on how to increase your credit rating based on affordability. I like that they give you options for refinancing auto or mortgage or credit card mergers. I would like if there was communication with a real person to ask questions. Example being, if I have 4 collections, 1 being a lot more to pay off but the other 3 are way easier to pay off…Do I work on the collection that indicates “high impact” which is the collection that has a way higher balance to pay off or just work on paying the lower 3? For example! Overall, I love the app and want to thank Them for having it. It helps me a lot and since I have downloaded it, I have increased my credit score by 65 points. 595 was what it was 6 months ago. Now I have 2 of the 3 agencies giving me a score of 633 and 648. Without this app, I’d be in the 620 range - So thank you very much.Version: 21.39

Alerted me to fraud!!!I’ve had credit Karma for years. I love it. I use it mostly to check on my credit score since I’m trying to pay off some cc it makes it easier to see all of my accounts as well as feeling encouraged when I pay them off seeing my score go up. Well last night I checked my email and saw an email from credit karma asking if I had opened a new account with Verizon. I didn’t so immediately I knew that something was wrong. Was able to confirm with the app that there was in fact an account I had no knowledge of in my name. So I disputed it with Verizon and they confirmed it wasn’t me that opened it and closed it down and will have it removed from my credit report. With this happening I also put a freeze with all the cc bureaus so nobody else can make more accounts with my info. Had I not had credit karma I wouldn’t have had any clue about this so I’m really thankful I downloaded it and check it every once in a while. I highly recommend credit karma. It’s been nothing but beneficial to me. Probably one of the most helpful apps I have on my phone to be honest..Version: 5.49

Great Service and Beautiful AppI’ve been using this app for a few years now. It’s a great credit monitoring tool! Easy, beautiful design and really a lot of info at your finger tips. I really have zero complaints about using Credit Karma or the reliability of their services. I do however have one complaint and it’s regarding the app for iPad. I have my App Store filter set to only show iPad apps and Credit Karma still shows up. However after installing I noticed it responds like an iPhone only app. It can only be used in the Portrait screen orientation, has the enlarger icon in the bottom right and it is VERY pixelated. Granted I am using an iPad Air 2, so it’s a little older but I’ve not had any issues with other iPad/iPhone compatible apps. I use my iPad as a laptop (built in keyboard and such makes it just like a laptop) so to have it where it only works in portrait orientation means I can’t use it in landscape orientation, and the pixelation makes me want to use my iPhone, but when using the CK Tax Service, well, I don’t want to have to do that whole process on my phone! If this gets fixed, and this app is truly updated for iPad compatibility, it is well worth 5 stars!.Version: 5.30

Recommendations are crapGood for keeping track of your credit report, but the recommendations they give you are absolute rubbish. They recommend cards I already have. Other times they tell me I have no chance of getting cards I am constantly preapproved and prequalified for. They also recommend cards I can’t get prequalified for. Not sure why they continue to recommend credit one and first progress despite the fact that I have nearly 700 score. They need to have a way where we can set preferences. I’m tired of getting recommendations that I will absolutely never ever ever ever ever ever ever ever ever ever ever use. It wouldn’t matter if my credit score were 430! I would never use credit one or first progress or Merrick bank. I understand that they make recommendations based off of who sponsors their site, but you would think they would have the smallest amount of integrity in their recommendations since they claim to help people rebuild their credit. I would never recommend any of those places. So many fees, no grace periods, the list goes on. Please allow us to set preferences for our recommendations because I’m tired of getting them for cards I will never use..Version: 21.26

It’s a decent starting pointI’ve used this app for well over a year and a half. It’s a good free starting point to learn what’s effecting your credit. After reading articles outside of this app, I learned steps needed to improve my credit. Credit Karma helped with the basics (account balances, when creditors reported to the bureaus, etc.). When I refinanced last year I saw that Credit Karma was showing 40-50 point less than what the bank pulled. So, I kept this in mind moving forward. A few months ago I worked on boosting my score 40 points or so, continued to use Credit Karma with the understanding their scores are not accurate... recently I subscribed to FICO for my scores, and yes Credit Karma is anywhere from 30-60 points lower than FICO actual (depending on which of the 2 scores CK provides). Bottom line, Credit Karma is a good starting point for people looking to improve their scores. Just keep in mind the scores they provide are not accurate but the other reporting data is pretty much on target (balances, dates bank report info to the credit bureau, etc.). Good luck, getting into the understanding of how FICO scores work and working on improving them really can change your consumer behavior for the best!!!.Version: 5.57

Credit FixerI love this app- while the credit scores may be different from other reporting agencies (there is a 50 to 100 swing) this app allows me to view things that my husband and I share in common. This app keeps me posted on how our bills are progressing allowing me to focus on repair. My credit score has improved from good to excellent in 4 years. While I have not applied for loans or cards suggested on this app, I have been working hard to pay down loans and cards recovering money previously paid in interest and/or principle. I have also learned a lot about how to improve my credit scores by focusing on high impact portions of my credit. My bank made an error in reporting that I had missed a payment and was 2 months behind- I was able to address this quickly- got a letter from them that it was their mistake and worked with the bank to correct it in all three credit reporting agencies. My credit score is now back to excellent. We have much more controls of our finances- and this is a pleasant way to check your balances and keep focused. Did I tell you I love this app?.Version: 5.20

Don’t understand why?Credit Karma has been great for keeping up with my scores I recently had a old account show up that had been paid for already and shouldn’t have been put on my report at all and it took away 2 of my points. So I decided to do a dispute through Credit Karma to have it removed and it was removed which was great to see. The only thing I don’t understand is why I didn’t get the 2 points back on my report?? This shouldn’t have been put on my report at all!? So now that this has been rectified I should have been given back the points that shouldn’t have been taken away in the first place and I’m not understanding why I haven’t been told anything about why I haven’t been given my lousy 2 points back when this was paid and shouldn’t have been put on my report at all!?. Why am I still being penalized for someone else’s mistake.?.?.... If it was my fault I would understand but it wasn’t because it was taken care of so it would Not go on it in the first place if I don’t get them back its just not right.???.Version: 22.22

Bryan SandersThe two Capital One cards are cards that we use to put all our monthly expenses on. We receive points and money back by using these cards! Then EVERY Month we pay them off in FULL!!!! The two Auto Accounts are for Brand New vehicles that we use in our Delivery Business! We have 12 Vehicles, only two are financed and only 60% owing! All the rest, 10 are PAID in full!! The Sleep Number Account, is a 6 year No interest if paid on time, which we do and 80 % PAID off! What do we have to do? We make all payments on time, we have never missed a payment. We keep our charges down to a minimum! Our net worth is over $5,000,000! I don’t understand why we are punished like we are? But I am beginning to not care! No matter what we do it’s not enough under your system!!I I guess you just have to pay CASH for everything but then you would say we never have an Account that we made payments on so you can’t give us any credit ratings! I am sure this won’t change anything but it made me feel good writing it!.Version: 22.21

Feeling of great improvements in lifeTo those of you that have credit issues let me tell you that Credit Karma knows their business! I was relieved to see what my hard work and dedication meant after seeing my credit score increase. There’s nothing easy in fixing what’s been broke with me financially but Credit Karma helped me with what i couldn’t figure out on my own. I was feeling overwhelmed to say the least however CK gave me options I didn’t realize I had before. They showed me more options with different car insurance companies and loan officers/banks that could lower my interest rates and to make my decisions on how to lower my debt and increase my confidence. Most of the time they could tell me and show me the who, the why, the how, and the when. They could answer my questions. One should always be careful when making major decisions even with a good company such as CK so don’t let anyone talk you into anything no matter how good it sounds. BEWARE: Do your homework first before making any financial decisions!! Good Luck!.Version: 23.44

Free International Money Transfer 💸Enjoy high maximum transfers into more than 20 currencies while saving up to 90% over local banks! The cheap, fast way to send money abroad. Free transfer up to 500 USD!Version: 24.13

What do you think Intuit Credit Karma ios app? Can you share your thoughts and app experiences with other peoples?

Please wait! Facebook comments loading...