Experian

ExperianExperian® Customer Service

- Experian® Customer Service

- Experian® App Comments & Reviews (2024)

- Experian® iPhone Images

- Experian® iPad Images

Get your Experian credit report and FICO® Score* with a free Experian membership—no credit card needed! Learn how to instantly raise your FICO Score with Experian Boost®ø, get notified about changes to your credit and more. You can even open a new Experian Smart Money™ Digital Checking Account—it’s FDIC insured with no monthly fees or minimum balance¶ (see terms at experian.com/legal).

GET STARTED FOR FREE

• Experian credit report & FICO® Score*

Check your FICO Score and credit report anytime, anywhere—it won’t hurt your credit. Sign in for updates every 30 days. See what factors help or hurt your FICO Score, and actions to take for better credit.

• Experian Boost®ø

Raise your FICO® Score* using bills like your cell phone, utilities, video streaming services & eligible rent payments.

• Experian Smart Money™¶

The Experian Smart Money™ Digital Checking Account helps you build credit without debt by automatically connecting to Experian Boostø!

• Credit monitoring

Stay informed with push notifications if your FICO® Score* changes, accounts are opened in your name or new inquiries appear on your credit report.

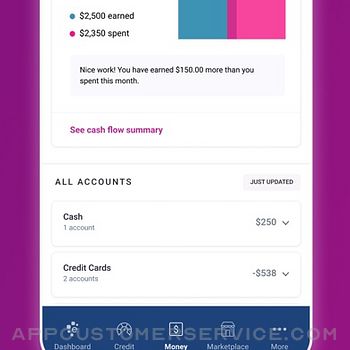

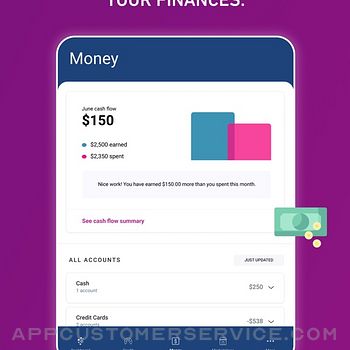

• Money management

Connect external bank & credit card accounts to see all your income, transactions and balances in one place.

• Marketplace^

Compare credit card, loan or insurance options matched to your unique credit profile.

PREMIUM BENEFITS

• Bill negotiation & subscription cancellation**

Save time and money when our experts negotiate your bills to get your best price! We'll even cancel subscriptions you no longer use.

• Experian CreditLock***

Protect against identity theft by locking your Experian credit file. We’ll alert you in real time if someone tries to apply for credit in your name while your file is locked.

TERMS

See experian.com/legal for Terms of Use Agreement, Privacy Policy, Cardholder Agreement & Disclosures.

¶The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

‡To be eligible for the $50 bonus, your Experian Smart Money™ Digital Checking Account must be credited with at least $1,000 in direct deposits within 45 business days of opening your account, and your account must stay active and in good standing at the time the bonus is paid. The bonus will be deposited into your account within 10 business days, once earned. Terms and conditions apply.

øResults will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®.

*Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether.

**Results will vary. Not all bills or subscriptions are eligible for negotiation/cancellation. Savings are not guaranteed, and some may not see any savings. ***Experian CreditLock is a separate service from Security Freeze: experian.com/freeze/center.html. Learn about the differences between them: experian.com/blogs/ask-experian/whats-the-difference-between-freezing-or-locking-my-credit/

^Based on FICO® Score 8 model. Approval is not guaranteed. Some may not see savings from improved interest rates. Offers are not available in all states.

©2023 Experian. All rights reserved. Experian. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses & Disclosures: experian.com/help/cm-licenses-and-disclosures.html

Experian® App Comments & Reviews

Experian® Positive Reviews

The best Credit Monitoring App I’ve used!Love The Experian app! I have been using the this app for about 4 months. What I love about the Experian app is that it shows accurate information using the FICO score 8 model which is what lenders use. Other monitoring apps use a Vantage score model which lenders do not use. For people that have negative reviews about this app is solely because they do not have a clear understanding of how credit reporting works and are uneducated in this, the 3 credit bureaus may have different scores because lenders don’t report to all 3 bureaus and are not required to so each bureaus make up a score based on information given to them by lenders or creditors. I did the Experian boost and immediately was able to check a refreshed credit card offers, I previously did not see any offers for credit cards that I wanted, but only saw offers for cards not really known or newer such as credit one and revvi and I was not interested in these cards. Using Experian boost I finally got a credit card recommendation for a discover card which is one I’ve been wanting for awhile! I immediately applied for a discover card and was approved!! Thank you Experian!.Version: 3.5.13

Experian BoostAlthough I like the Experian app, I am definitely disappointed in the boost part of it. I have been trying for weeks to get the boost part to work with every attempt telling me to speak with my bank. It then says it cannot find any qualified bills. What? I’ve been paying bills for quite some time now. After many phones calls and being put on hold only to be disconnected, I learn that bcuz my account is a business account it doesn’t work. I have No employees. I make money. It goes into my account and then disburse it accordingly. Pay bills. So I need to open another account and transfer money from the business account to the personal account. I’ve read everything I can find and I didn’t find this being said at all. Had I known this, I wouldn’t have been putting in so much time and effort into this boost. I’m still confused as to why it wouldn’t work being I am paying MY bills with MY name on the accounts. The business account is in my name as well. I can’t believe I’m the only person that has only a business account and not a separate personal account as well. In any event, how about leading with this information Experian? “Just link your bank account…UNLESS IT IS A BUSINESS ACCOUNT! WE CANNOT HELP.” Is this a good program? I have no idea. Apparently, don’t pay your bills out of your business account, they can’t help….Version: ECW 3.5.16

Other chargesI’ve been using Experian for a while now. I’ve been keeping up with credit report/score on here and with the other credit bureaus. I paid the fee to get the extra protection but now it want to charge me to get credit reports from the other two bureaus. I found inaccurate info on all 3. Names attached to my info and address that wasn’t mine attached as well. I was trying to get a car, but was denied because of credit score. I went to that particular credit bureau that provided info to car company and it showed my credit score was totally different from the one that was given to auto company. My credit score on Experian is 759, 614 and 724 on the other two. The auto company sent me rejection letter saying my credit score is 513. I have been a victim of identity theft because some of my info was used to obtain services and they were able to withdraw the funds from my bank account for said services. I had to close that account and was given a new one along with a new bank card. I never received an alert. I have my bank info along with other info monitored with credit bureau but for some reason no alert was sent. If my info is being monitored, why didn’t I receive an alert especially if I’m paying for the extra/added protection?.Version: 4.0.4

Experian is nothing but a fraud!!!Experience still has me down 109 points while Trans Union and Equifax has me at 109 points they seem to not be reporting the correct information when I try to dispute they tell me they cannot dispute. They Luer me into applying for credit cards they said I would be a perfect match for an order to have open trade lines to increase my credit score then upon getting denied because of experience low credit score which Trans Union and Equifax have me 109 points on my credit score, I was promised that those credit card applications would not be hard inquiries but again that was a lie and they continue to show them as hard inquiries on my Experian credit report which brought my credit score down five points which I am trying to dispute and they have a number it says you can dispute hard inquiries but upon calling they had me on hold for over 30 minutes while they were investigating it then transfer me to someone new who didn’t know anything about why I was on hold and told me that they cannot dispute hard inquiries I have to call the creditor which is a load of crap!!! Shame on you Experian!!!!!!.Version: 3.1.4

Automatic auto payI cannot stand how every time you sign up with an account with an Experian representative or on the app it automatically signed you up to make a 2499 purchase and other I’ve seen five and $10 purchases without your consent or knowledge of consent and then they outsource your information to foreign countries, They use individuals who work from home from India Pakistan and other places that actually sell your information on the black market or the dark web. So while allowing their employees to sell your information they’re also billing you without your consent and not allowing you to utilize the free, free credit report app like you have stated in your contracts. I have fully reviewed your contract and then nowhere does it say you have to call in and cancel out the free subscription before the charges are automatic. Therefore they’ll steal your money let you look at your credit and then sell your information on the dark web by way of their employees that they hire outside of the country which causes the data breach in the first place. You guys need to fix your entire system.Version: 3.4.0

Constant and Informative Monitoring (good news and bad)-If your on a rebuild, for whatever reason, or if it’s your first time taking a serious approach to building and maintaining your credit, this app helps to keep you in the know at all times. It gives you an idea of what may happen with different decisions you have the opportunity to make and whether they will help or hurt. You have to crack a few eggs to make an omelet. This lets you know the positive and negative aspects of each potential decision which allows you to know whether it will be worth it not. Even the things that Experian points out that may affect your score negatively (sometimes just in the short term…sometimes not) are learning opportunities. -It is a marketing platform but I think they strike a good balance of trying to be helpful and trying to generate funds from the service they provide. *The trick is to UTILIZE THE ENTIRE APP INCLUDING THE EDUCATIONAL MATERIALS. Ignore the marketing until you can use it to your advantage. Sometimes what hurts in the short term, helps in the long term, etc, etc, etc. EDUCATE YOURSELF AS YOU BUILD YOUR FINANCES!.Version: 4.0.13

I didn’t think I’d ever say this?Having been a stay-home mom for 16 years, I never considered how it might affect my personal credit. It was worth everything and I’ll never regret raising my children and never missing a game or school event! Now that they’re grown up, I hadn’t considered that NEARLY NO CREDIT was almost as bad as bad credit! I had trouble getting a single credit card, just for small purchases. Since I’ve been with Experian, I discovered an old neighbor was been using my name & information (still working on that). There were also things that I knew about, but should never have existed on a report of any kind- were reporting negatively on my credit score! Experian helped successfully REMOVE/ DELETE one and we’re still working one other. For the first time in a long time, I’m excited for what’s to come! Thank you, Experian for helping me navigate these issues. I would have just been stuck without their help! I would recommend ANYONE trying to build/ repair their credit to let Experian help! Thank you for helping me resolve these issues fairly!🙌.Version: ECW 3.6.2

Take a note from credit karmaExperian is very subpar. My credit score that is displayed when I first open the app is never accurate; I even have alerts in the app that say my supposed current score(cause it’s always different from my other two scores) yet the score displayed is still old by over three months once. Also, this score fluctuates A LOT for no reason. Compared to my Transunion and equifax scores that I monitor on credit karma, that is always reflected accurately and quickly after any changes, this score drops all the time for no reason, and there is no reason stated and I haven’t done anything risky besides pay my bills, and there is no way to find out. Whereas, in credit karma it tells you exactly what changed, when something actually does change in my life like I’m reducing balances paying bills or applying for cards etc., and why it changed and it is very easy to find. Also boost so far is misleading. I added a phone bill and it boosted my score 6 points, then just as quickly dropped my score 6 points because I added a new credit account to my profile..Version: 2.10.0

LockedI tried to update one of my old cards through the bank that purchased the company cardholders info. I went through the company’s application process, passed that, then was told that I had to contact Experian to unfreeze my account. Went Experian’s question process, got all the questions answered correctly. I then called company back with the pin, to be told that the file was still frozen. The credit was not able to use the pin because that is not the way they do it. Had to go and do a temporary unfreeze, that worked, got denied the card from the bank, after answering all the questions correctly from Experian. I have very good credit. This was for a purchase I wanted to make before the price increased. All I needed to do was update my old card. I now had to leave my credit file unfrozen for a day. I was able through the App to lock my file back. There is no way to speak to anyone to get problems like this resolved. Extremely disappointed..Version: ECW 3.1.3

Credit reportingHello my name is Scott I am a current user of Experian. However the 6 months + I have been using the app so that everything I have as far as credit reports would be some what recorded and that I could at least have the bureaus looking at my file and seeing that I have paid off all my revolving credit lines with that being said Experian has not been reporting any of my payoffs and I’m not sure if it’s my credit line issuers or if it’s just somebody not actually doing their job or what but on Experian in my account it states that I have the same amount due of revolving credit and it shows that I haven’t paid it off which I have several times and the amount of my installment loan is wrong it says I owe 80 % of the amount and and I done paid the loan off almost over half way. All I’m saying is I have worked very hard for this . And I deserve for my file to be up to date like it should . Like why do we pay for the app. If you guys aren’t gonna do your job? Like report my hard work to the Bureaus like you’re supposed so people like me can have all there hard work recognized the way it should be..Version: 3.3.3

Awesome Credit AppPrior to using Experian’s credit app, I used Credit Wise from Capital One. In rebuilding my credit I wanted to monitor my credit accordingly and make the right moves to increase my score. Maybe, there is a glitch with CreditWise but my score always sucked no matter what I did. Paying on time, minimizing my utilization my score was horrible. I switched to Experian and my score was decent. Experian gave an accurate reflection of all my hard work and financial discipline. I love Experian Boost, which basically rewards you for things that you always pay such as rent and my celular bill. I also, like the credit card recommendations they send you as your Credit improves. With this feature I can know what cards I am more likely to be approved for. Finally they also make it super easy to check for any erroneous information on my report and have it disputed within 30 days. Experian is by far the best credit app on the market today..Version: 2.8.2

Keeps me up to date, almost. But .....Let’s me know in latent real time what’s going on with my credit. But offers very little real help in combatting incorrect information or recently helping to dispute a late payment with my mortgage which my bank has already written a letter to and they ignored. If Experian were to be really on the consumer side they would over ride the false late reporting, supported by Chase Bank. I haven’t missed a payment on anything in 4 years. Stay away from Sunwest Mortgage; not consumer friendly, they do not do digital notifications or secure email unless it suits them. They also keep you on hold for hours, constantly transferring you, never really helping to see all data or see the big picture. Had they properly communicated a transaction that “hung”, I wouldn’t have to waste my time correcting a mistake which could have been easily resolved with modern communication. So when Experian can be objective, I would improve my rating; now they are just complacent in this issue..Version: 2.8.8

A Very Useful AppKnowledge is potential power. One big problem I had in trying to become a better steward of my finances was to know my current credit score. Seeing that a good score provides ready access to securing any big purchases, I realized that I needed a reliable app to know, at least, where I stand credit-wise. The Experian app provides me this opportunity. It’s very useful. The app allows me to see all three credit scores. Moreover, it shows what financial activities are helping and hurting my credit score. Finally, the Experian app gives me alerts as to what is happening with my credit information in real time. This useful information helps me rethink my purchases and it’s potential impact on my credit rating. As a result of this knowledge, my credit score increased from the low 500’s to the mid 700’s in about three years. I recommend this app to anyone who is serious about obtaining a better credit score..Version: 2.9.8

Credit score increase of 80 pointsSince downloading the Experian app and being able to explore all of my account balances, installment accounts & balances, & collections on my credit report, I’ve paid all collections off and have been closely monitoring my report. Since I first downloaded the app, about 3 months ago now, by being very proactive and dumping a bunch of money into my accounts and erasing collections my score has shot up 80 points over the three months and continues to rise every time a new score update is available. This is all because now I am working towards having optimal credit so I can refinance my car and maybe even purchase a house. Having good credit definitely makes your life much easier, so if you care about your credit score, this will help you monitor it and put your money somewhere it should go so that it will be beneficial to you later. Thank you for reading..Version: 2.7.3

Credit Score vs Aging PopulationCredit Scores are a necessary evil but they are biased against the older population. My wife and I have $195K in retirement income, $2.5M in 401s, $2M in savings $1M in stocks, $2M in Tax-Free Bonds, and houses/property. So we don’t borrow money and pay off our debt at the end of the month. Historically, we had several organizational credit cards: Sears, JCP, Dillard, Shell, Belk, Lowe’s, etc but decades of bankruptcies and corporate failures have reduced these cards to only one card. Added to this is the financial organizations belief that older customers are a higher risk than younger customers and credit limits are reduced even if you have an excellent credit history. Recently, we were going to buy kitchen appliances and we were offered a discount if we used a company credit card. We applied and were granted a card with a $1K credit limit! The appliances were back ordered so I charged them on another credit card with a 12 month “No Interest” option. Our credit ultilization increased even though the appliances were back ordered and we did not have to pay for the purchase for 12 months. I do not need a car loan, a mortgage, or a personal loan but I get offers for these services daily. Perhaps, it would be better for companies that to target their advertising toward the population that needs these services..Version: ECW 3.5.18

Experian is great, simple as that.This app is awesome. It’s so easy to use my 4 year old could navigate around it. It gives you tips on how to boost your credit score that actually help, it allows you to link small easy to keep up with bills to your credit, it puts you in contact with lenders that will give you a credit card with good rates and it provides you with update info on your credit score regularly. Experian is the perfect app to use if you’re young and trying to build your credit up like me. I’ve been using the Experian app for about a year now, my credit was in the high 500’s when I started. After 1 year of using it I’m in the mid 700’s. I literally couldn’t even get a $500 payday loan a year ago, now I have a mortgage with an amazing rate. If you’re not using Experian to get ahead in your life you’re a flat out simp. Good luck chumps..Version: 2.10.3

Great app, until it started with fluff notificationsI’ve been using this app for around 8-10 years. It would send me useful notifications about my credit profile and potential issues as soon as they popped up. But over the past few years, they started sending fluff notifications about credit card offers and “great credit utilization”. These are not useful notifications. I tried to filter the less useful notifications, but there isn’t an option to do so. So if I want to be kept aware of any potential problems, I have to accept their garbage/fluff notifications as well. I’m sure they are getting some kind of financial compensation for pimping out credit cards, but if I pay for a service, I expect to not be the product they sell to others. This is classic double dipping. They shouldn’t be in the credit card offer market when we rely on them for credit report info and credit profile maintenance. Great app/service otherwise..Version: ECW 3.6.2

Little to no customer serviceI was really enjoying this app! I recently purchased a new phone and I have been unable to log back in to the Experian app since. I have contacted the customer service number multiple times. It loops you to where you never get a live person. The automated messages continually tell me to log in for assistance, but I can’t log in! I even tried email prompts and changing my password. Not sure what else to do! I am still getting email alerts about “changes to my credit” but I can’t log in to see them. Such a bummer. Prior to this issue, I was a fan of the app and the conveniences it offered in keeping me on track with my credit monitoring. I felt secure knowing that if there was ever an issue, I’d be alerted right away. I have been pretty frustrated with my attempts to make contact with someone who can assist me in gaining access to my account again!.Version: 2.7.0

Experience the BestA lot of the times your credit rating moves as slow as a snail. You try your best to be a good consumer and be consistent with your financial situation. Being a senior on a fixed income which dwindling faster than you can keep up with all involved. Experian has been fair and makes me feel that my efforts handling my finances makes me feel I still matter and at least doing fair when others of the triad rate me poor or less. I am not behind in any of my accounts and I have a car note that is more than 50% paid off on a fixed income on disability as well as paid off almost all my accounts except 3. Experian allows me to keep track of this mess and make sense of it and keeps me from throwing in the towel like a lot of folks have had to do in my situation. I have had to make slot of sacrifices to keep my credit profile where it is. Thanks for the help!!.Version: 2.7.0

Excited AND AmazedAfter learning of Experian Boost I did a ton of research and was both excited and ready to give it a try. I haven’t had the best track record as it pertains to managing my credit and ensuring I am in a good and healthy financial position but decided I wanted that to change. In the hour that I have been with the program I have boosted my score 78 points, utilized simulations available via the app to see decisions I CAN make to continually increase the health of my credit, learned the unhealthy decisions I have made which have affected me negatively,been matched with lenders to “thicken” my “thin” file, and enrolled in credit lock/monitoring. The research I did on this product betrayed the ACTUALITY of how great and much needed this product REALLY is! I, with the utmost sincerity, highly recommend EVERYONE, regardless of your credit health, to enroll in Experian Boost. You are doing yourself a great disservice in NOT researching and joking for yourself!!!.Version: 2.9.10

Gets the Job Done as a Simple Non-Premium UserI downloaded the app wanting one simple job: to check my credit score and to know if any accounts have been fraudulently opened in my name. So far, it’s been a smooth experience. Yes, sometimes the scores will differ from other credit cards or companies, but it’s really dependent on the type of scoring model they use. A lot of car dealerships and mortgages like to use Fico 8, which Experian also uses. I’ve found they tend to be more conservative than my credit cards, which is a great problem, as it means Experian shows my “worst case” credit score which is oftentimes lower than what many companies have pulled from me. They also have a lot of useful information for people new to credit cards, and it’s been an incredibly valuable resource to me. The app’s 4.8/5 rating is well deserved.Version: 3.2.7

NAME OF ACCOUNT’SI like when you can check your credit anytime and see what’s going on I froze my credit do you to Social Security card and other important documents got lost with all my information only thing would be really great as win you tell them that this account has increased and you might have the name of the bank well it would help more if you would give the name of the card or what the account is from Mike’s at Home Depot Home Depot alone from Hawaii when I said things go OK what Did I open because you don’t pay attention and then even though they have the name of the bank you have to go look at my cards or the bank statement for the statement from credit cards but it would be nice like Home Depot and you know the name or the billing from and then whether increase decrease crystal girl I fishy thank you very much.Version: 3.2.3

Great AppI absolutely love Experian app. I use to dread looking at my credit score because I didn’t understand it or how credit works. This app has made it so easy to understand and it’s very friendly to navigate and I feel safe and secure with it. I love the offers it gives and suggestions for boosting your scores or even checking the other scores from the other bureaus. I haven’t experienced any bugs or things needing repair in this app it truly is efficient. I love checking my credit score now and it has become part of my regular things to do. I’ve watched my credit score go from a 518 to now a 622 in 6-7 months and within this process I’ve use this app to watch my Credit score grow as I continue to repair and rebuild my credit. Way to go Experian I’m looking forward to my credit growing even farther with you..Version: 3.4.9

Moving forwardI’m really impressed on how easy it is to see all my credit history and how easily I can take control of my life by seeing my credit history. I can straighten out things that are incorrect on my credit report and also add whatever information to make it correct. To be able to see my credit report and see my credit score whenever I want is amazing. I have literally watched my credit scores go up right in front of my eyes. I have disputed things on my report and I was notified when they were finished with their investigation. I am aware of any and all changes that occur at all times. I get credit card offers that tells me of my chances of getting the offers. You also get credit help if you need it all in this app. I don’t like most apps but I love ❤️ this one..Version: ECW 3.6.1

Experience Credit BureauI haven’t been on the website in a while. I already knew that my credit score was increasing through my bank account and it is now the same score as my bank. I’m not sure what scale that you are using but according to my bank credit specialist at which I checked twice, said my score is higher than the Experian, and Equifax. I’m not sure about my score with TransUnion yet however I am going to check after I finish this email. Your Experian app seems like there’s some new added features. I think it’s great! However, the one thing that I think should be considered to be reviewed and revamped is the despite process. I think there is not enough room to explain why you are actually disputing the things that are on your credit report. I do like the fact that the dispute process is easy and they get it resolved in a timely manner. But some of the disputes are clearly resolved by stating “ take off. “ But, the the others are acknowledged that those disputes have been reviewed but, the wording is unclear in my opinion. I also want to say that I am glad that Experian has a 1 (800) phone number at which I have used one time a few months ago. I’m going to use again next Monday since I have been on the app in a while. Thank you for reading my email! Dorothy Warrick.Version: 4.0.5

Overall good to haveI am a bit obsessive about keeping my credit score in good shape, so I appreciate having this service. I do recommend it overall, as it has helped me over the years to see if something suspect is going on and to know where my credit and debt stands. Yes, it’s a worthwhile tool I use weekly and I will continue to use this service. This is more for corporate.... the new app isn’t as great or user friendly as the old version. I was forced to sign up for the new version, when the old version stopped working. I was looking forward to some noticeable upgrades, only to find a big credit card sign up suggestion section taking up most of the page. It’s more annoying than helpful. I hope you guys make some improvements, as I see I’m not the only customer feeling this way..Version: 2.3.1

Easy way toLock and monitor your creditI got a notification from a doctors office somewhere and they paid for a year of the service for me to monitor my credit. However, I found out that there is a free option where I can put a freeze on my credit and open it for certain things when I want to, and keep it locked down otherwise. super easy and I would recommend. I do not have my bank account and stuff attached to it because it freaks out every time I pay my rent which is stupid. Because my rent is a large amount. it also freaks out when I pay my credit card payments and stuff because it thinks there’s too much money moving in and out of my account. Which is none of the business so I would not attach my bank account but for monitoring credit cards yes.Version: 4.0.1

Free International Money Transfer 💸Enjoy high maximum transfers into more than 20 currencies while saving up to 90% over local banks! The cheap, fast way to send money abroad. Free transfer up to 500 USD!Version: 4.0.21

What do you think Experian® ios app? Can you share your thoughts and app experiences with other peoples?

Please wait! Facebook comments loading...